The Trump Effect

Investment Activities

With the outcome of the November 2024 U.S. election clearly decided, the markets have responded in overwhelming fashion.2

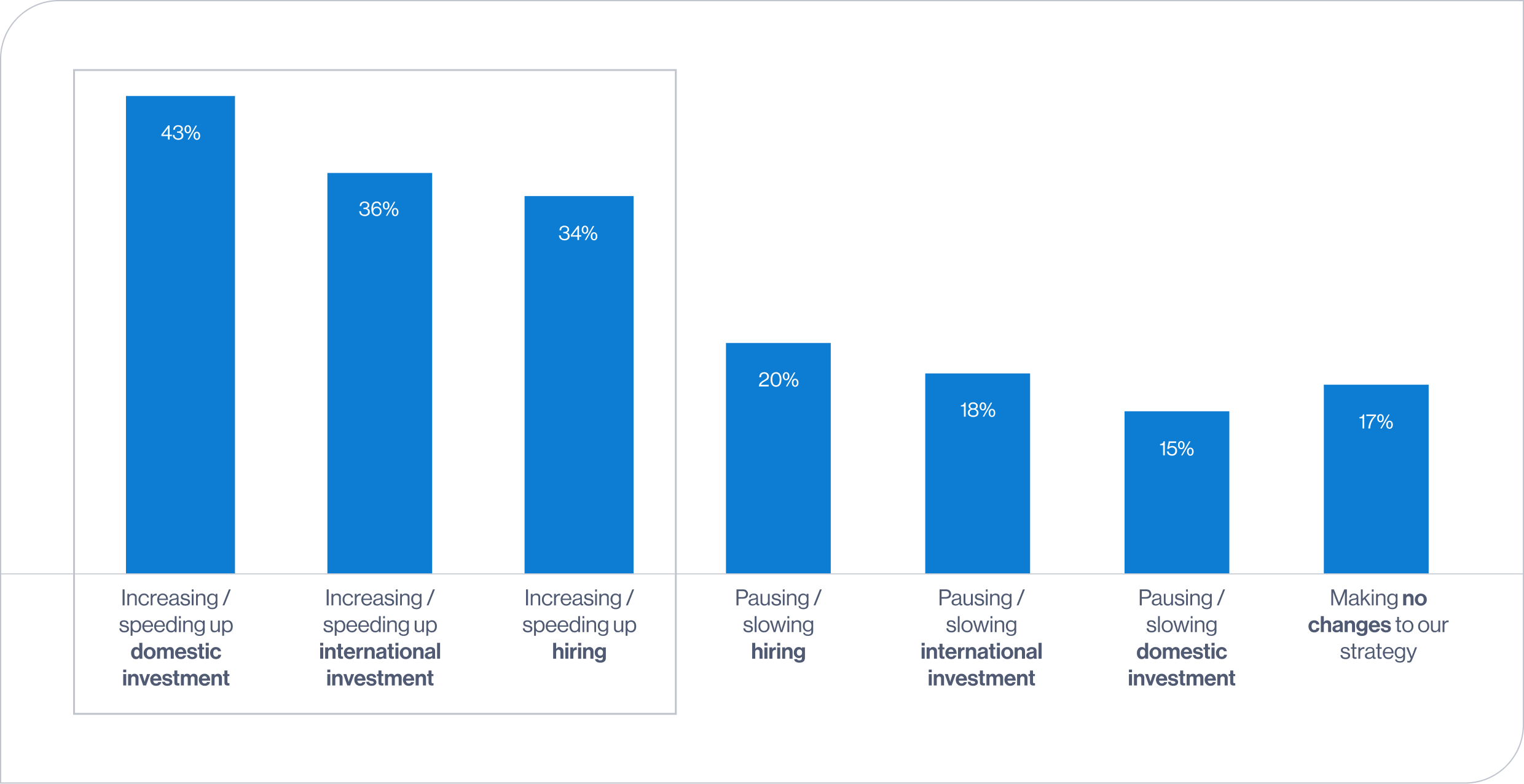

Looking ahead to 2025, global CEOs plan to ride this wave, with 43% citing plans to increase domestic investment spending and 34% planning to increase hiring.

50% of global CEOs are increasing investments in some way based on the results of the U.S. election.

Question: Based on the results of the 2024 U.S. Presidential election, which of the following reflects your business strategy regarding its outcome? (select all that apply)

Policy and Legislative Shifts

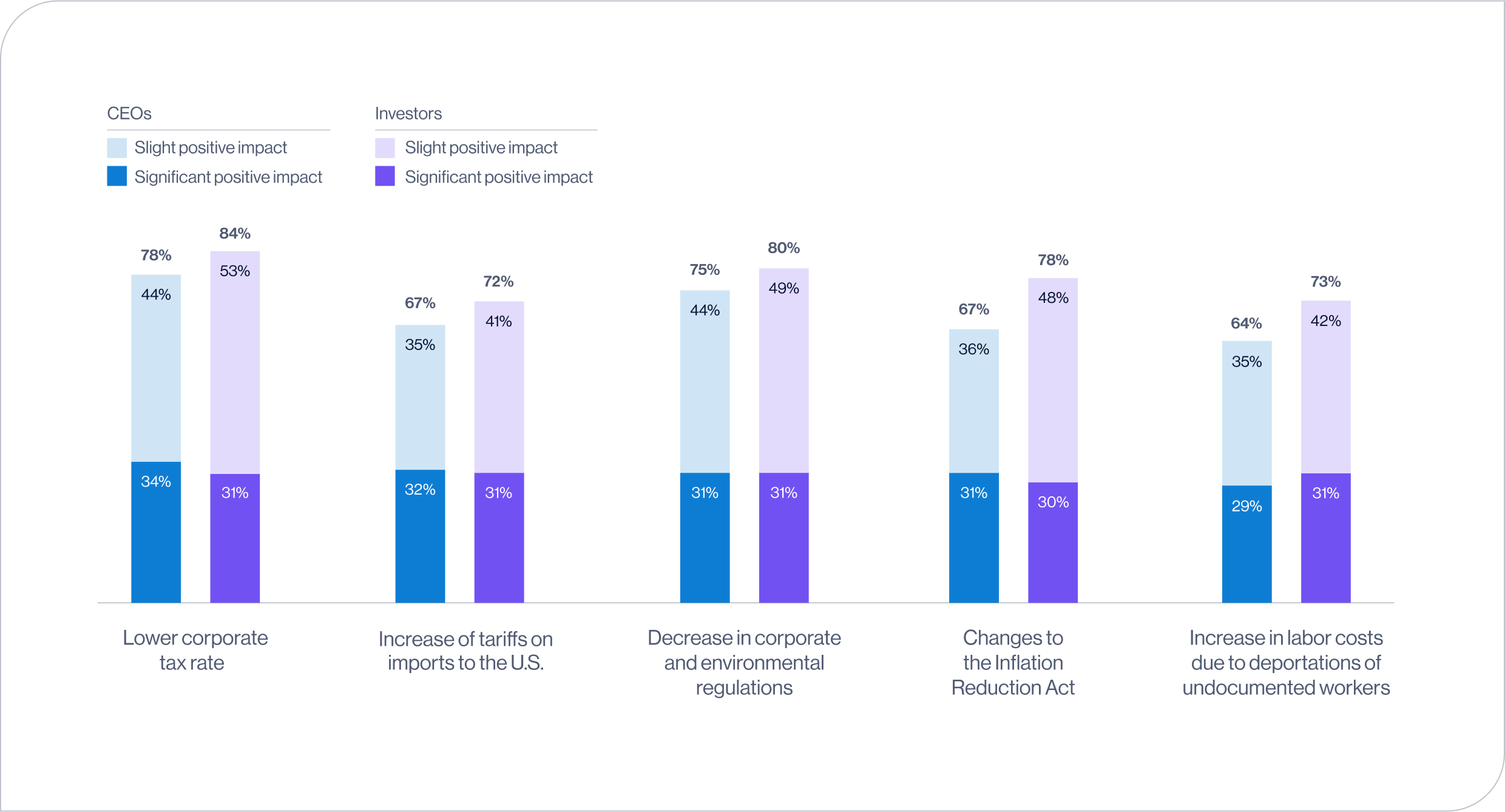

Despite some concerns over trade and tariffs, the prospect of lower taxes and decreased regulation are leading to new optimistic highs. In fact, more than 64% of total respondents indicate that a broad range of these and other developments will have a positive impact on their business, almost one-third of which predict a significantly positive impact.

Mid-cap company CEOs are decidedly more optimistic than their large-cap counterparts, especially around tariffs and labor costs. This tension highlights the dual impact of such policies, which may create challenges for many businesses, but also may open opportunities for a subset of companies that benefit from reduced competition.

80% of mid-cap CEOs believe that an increase of tariffs on imports to the U.S. will have a positive impact, compared to just 13% of large-cap CEOs.

Question: Anticipating a second Trump administration in the U.S., how much would the following scenarios affect your business strategy / leading corporations?

Corporate Preparedness

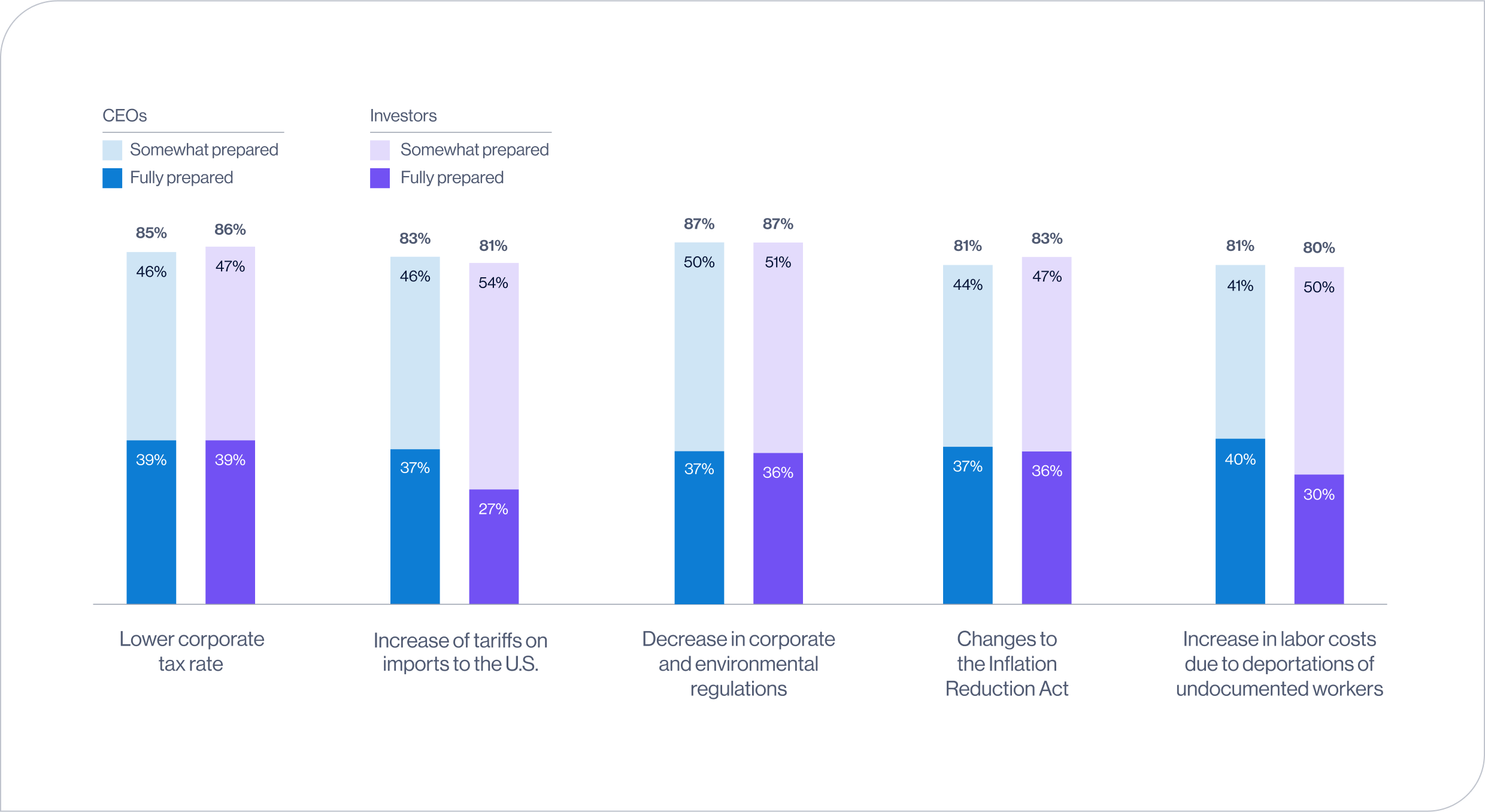

These likely changes have not come out of the blue. The majority of companies have spent months, if not years, preparing for election outcomes. In fact, survey data shows that 80% of respondents are well- (if not fully-) prepared for the wide range of policy shifts anticipated in 2025.

More than 80% of CEOs and investors are confident that businesses are prepared to handle various potential shifts in U.S. policy.

Question: How well-prepared is your business / do you believe leading corporations are to handle each of the following potential shifts in U.S. policy?

Likely Outcomes

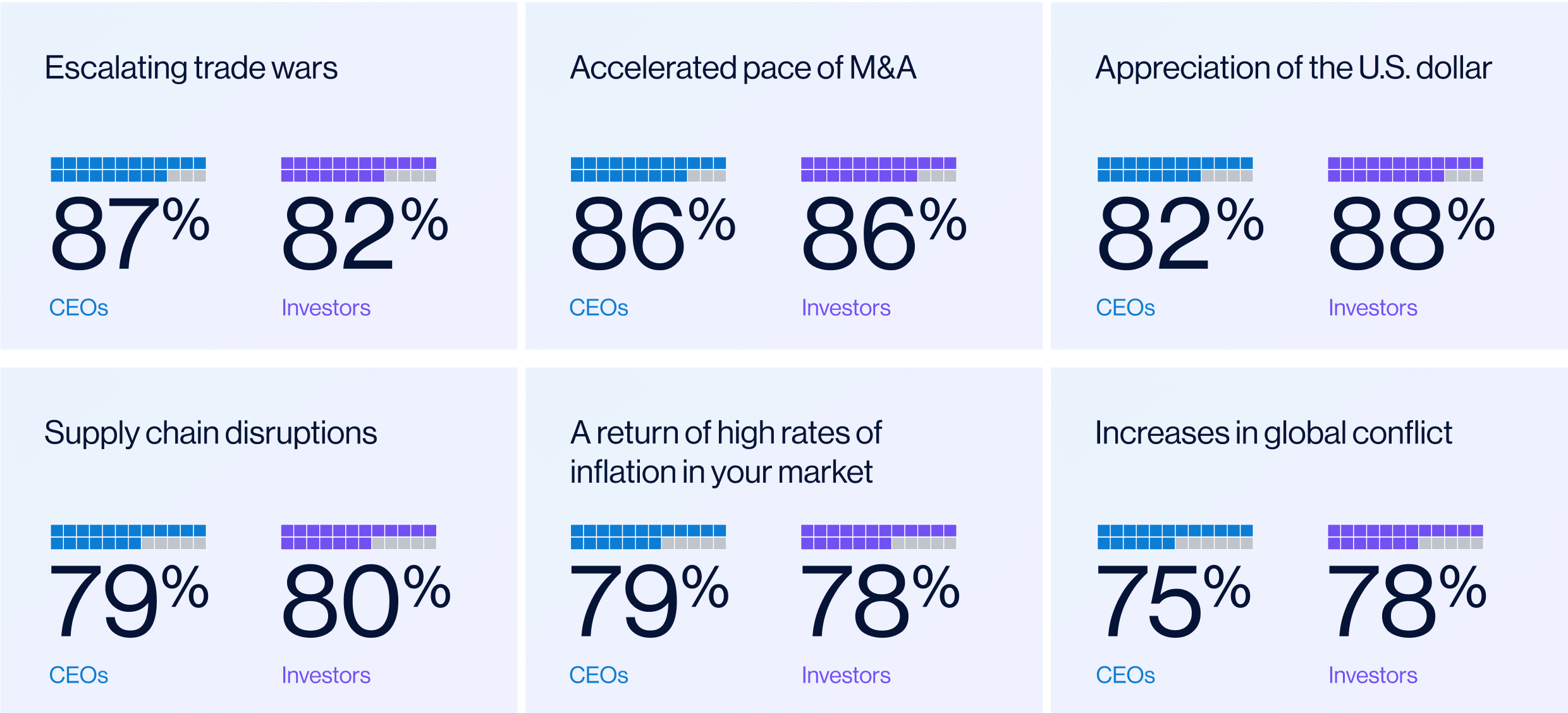

The survey reveals widespread consensus among global CEOs and investors that a second Trump term will lead to several consequential outcomes. Trade disruption, increased M&A activity and a strong U.S. dollar rank as the top three most likely outcomes.

Question: Looking ahead to a second Trump administration in the U.S., how likely do you believe each of the following will be?