Macroeconomic Outlook

Outlook for H1 2025

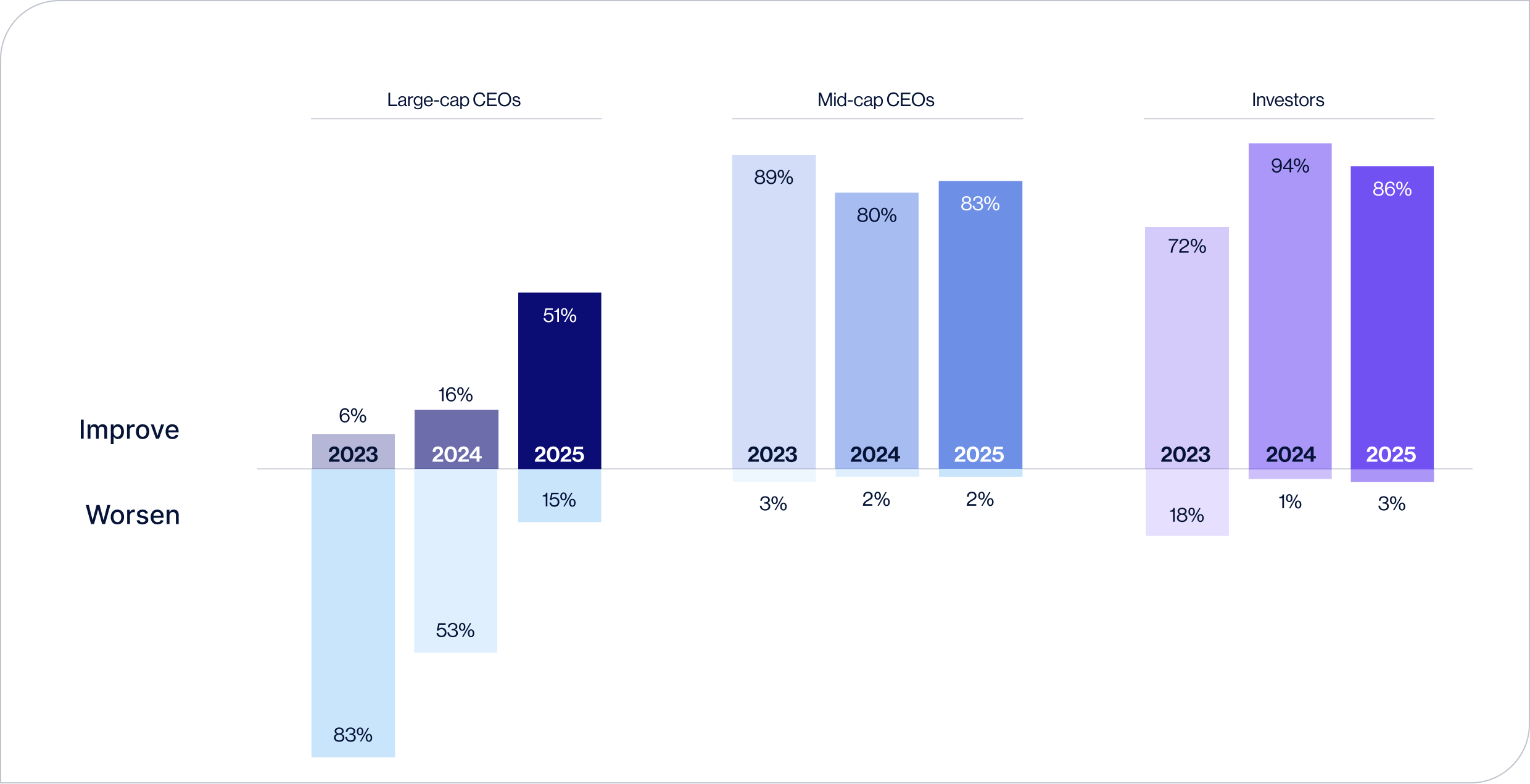

The global macroeconomic outlook for 2025 reveals growing optimism for the year ahead, with 77% of CEOs (compared to just 45% last year) and 86% of investors indicating that the global economy is likely to improve over the first six months of 2025.

In a significant shift from previous years, a majority of large-cap CEOs (51%) are optimistic about the year ahead.

77% of CEOs believe that the global economy will improve in the first half of 2025, compared to 45% last year.

Question: Do you expect the global economy to improve or worsen over the first six months of 2025?

Access to Capital

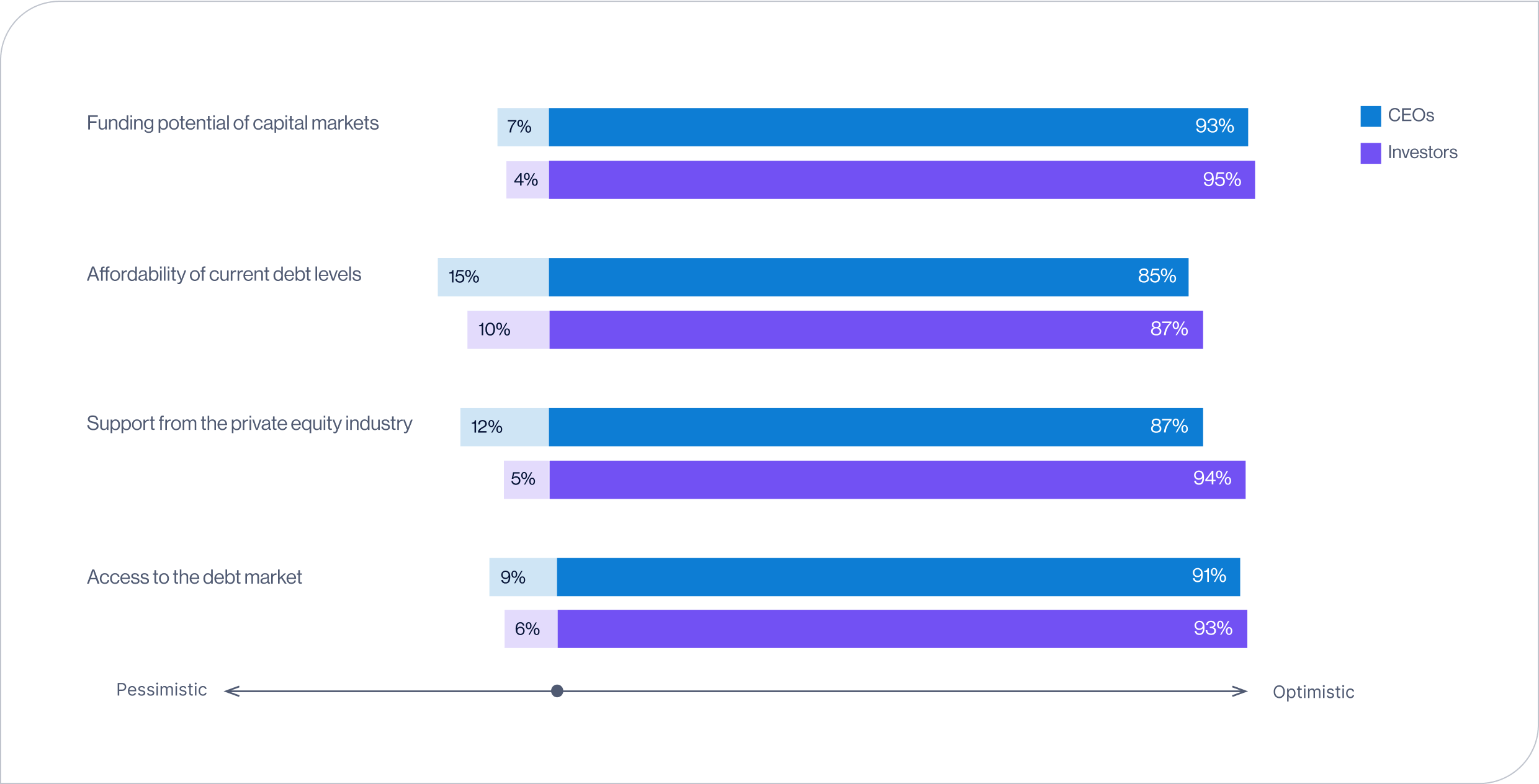

Positive sentiment is largely driven by expectations of easier access to capital. CEOs are decidedly more optimistic on this front compared to last year, bringing their expectations in line with that of investors for the year ahead.

Question: Looking ahead to the first six months of 2025, are you generally optimistic or pessimistic about the following?

M&A Outlook

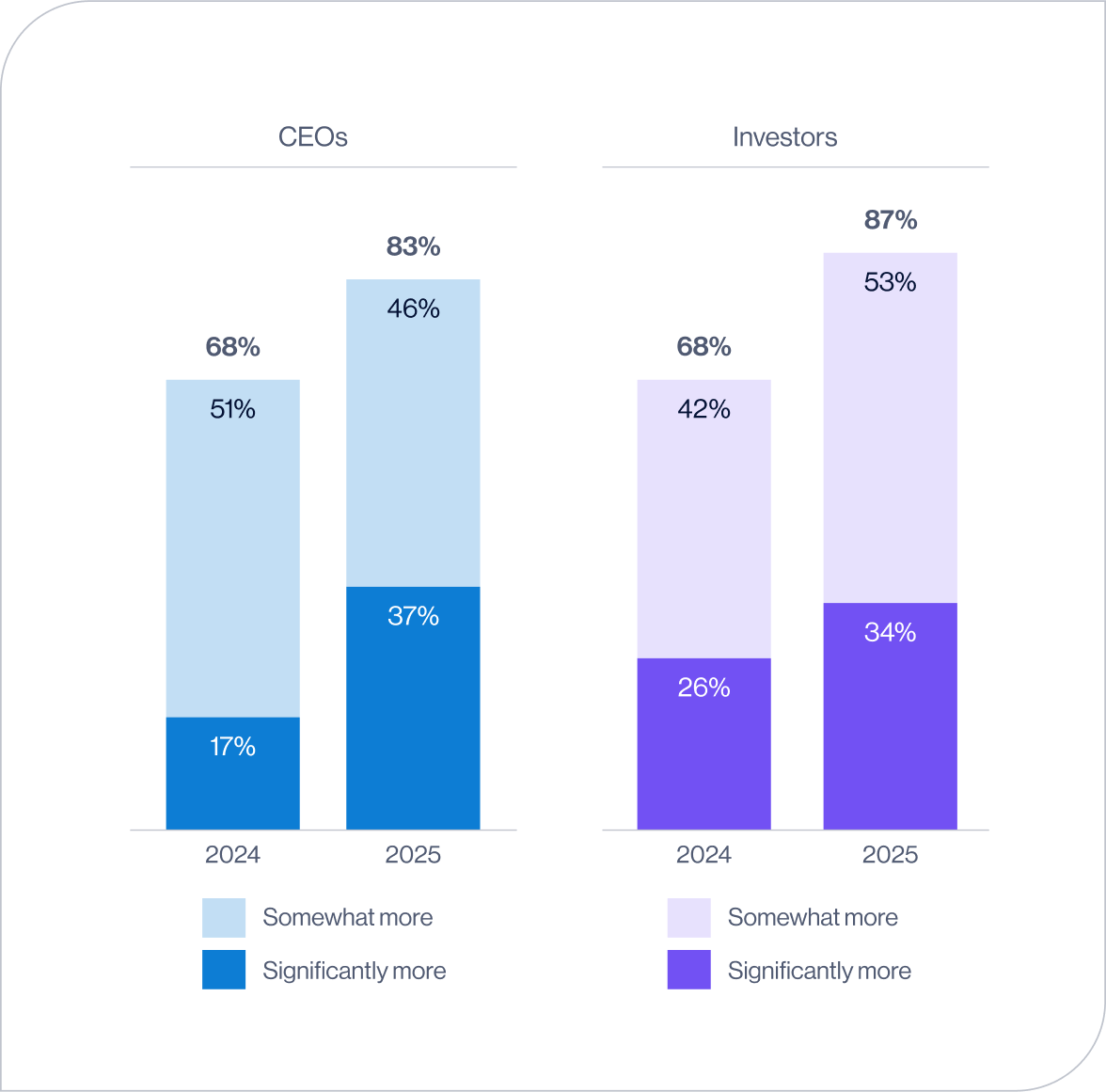

Greater access to capital, combined with the projected impacts of the incoming Trump administration, is expected to fuel a resurgence in M&A activity: 83% of CEOs and 87% of investors anticipate increased M&A activity in 2025.

In last year’s survey, 68% of both CEOs and investors predicted a rise in M&A activity in 2024. This has proven true so far this year, with deal levels (valued at $1 billion USD+) reaching their highest level in two years. The number of deals valued at $10 billion+ USD has doubled compared to the same period in 2023.1

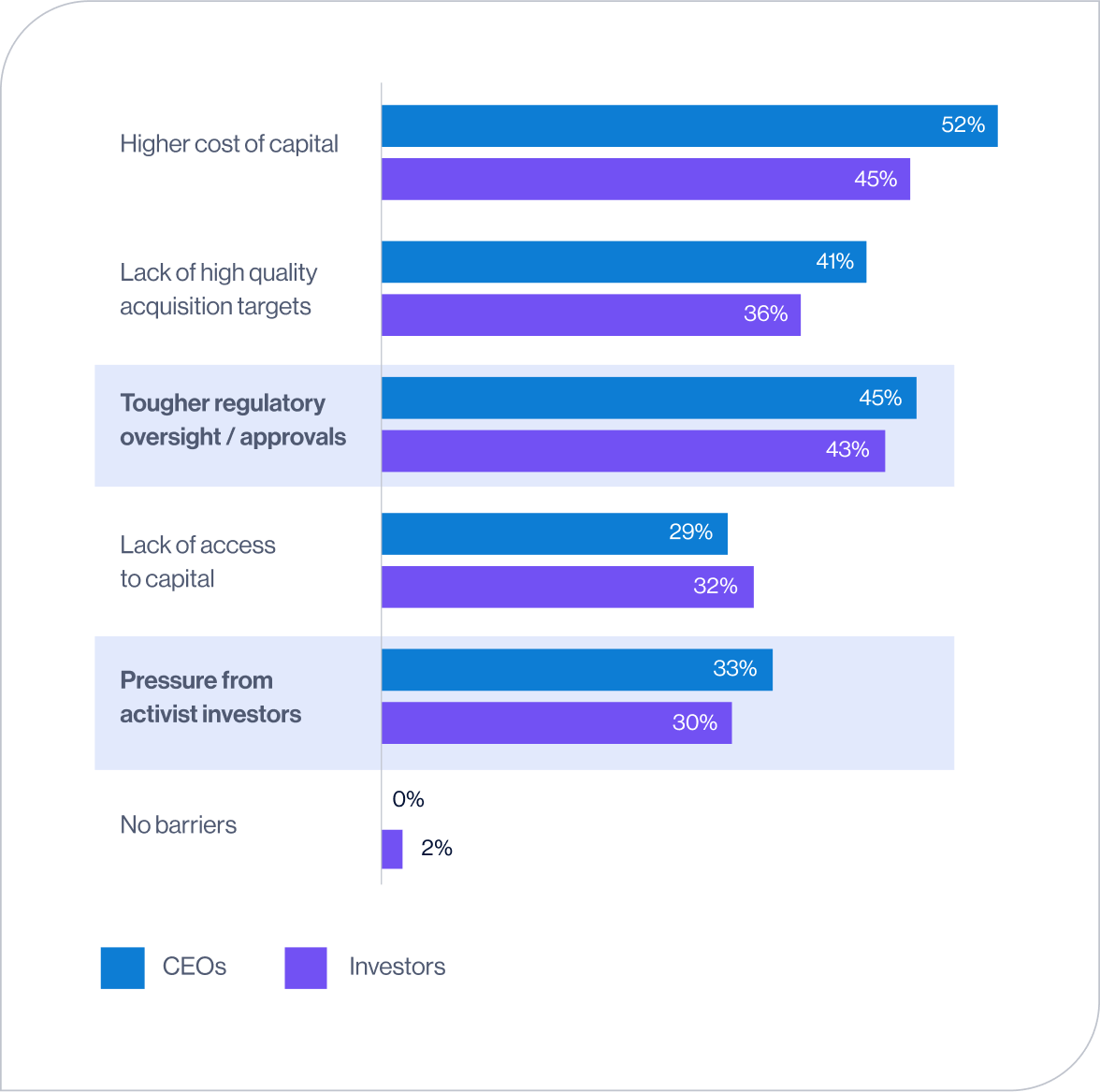

Looking ahead to 2025, CEOs and investors alike will closely monitor regulatory developments and anticipated increases in investor activism – both of which pose significant potential barriers to M&A completion.

80% of CEOs and74% of Investorspredict a positive impact on M&A completion as a result of the new Trump administration.

Question: Looking at the environment for M&A activity, are you generally expecting to see...

Question: Which, if any, of the following do you consider to be major barriers to M&A in 2025? (select all that apply)

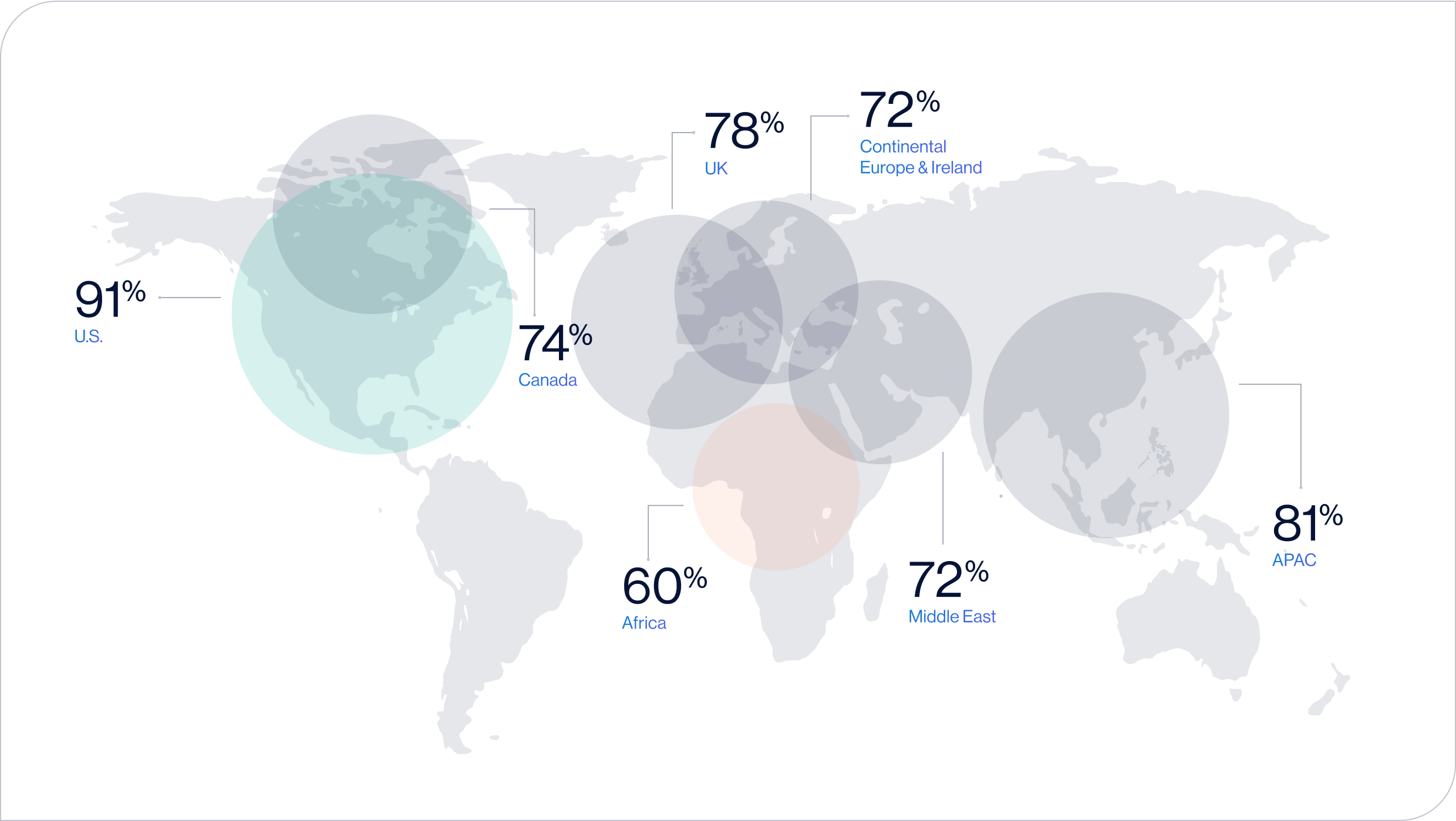

U.S. Emerges as Global Investment Destination Leader

According to global CEOs, the U.S. represents the most attractive investment destination in 2025. Conversely, Africa is drawing the lowest levels of global investment, with only CEOs from the Middle East identifying it as a priority target.

Businesses headquartered in APAC appear to be leading the charge in pursuing investment opportunities across various global markets. They are also looking to heavily invest close to home (95% exploring investments within APAC), with India emerging as the most attractive target.

70% of CEOs from APAC are looking to increase investment in India in 2025.

Question: To what extent do you consider that each of the regional markets below is an attractive investment market for your business in 2025?

UK Insights

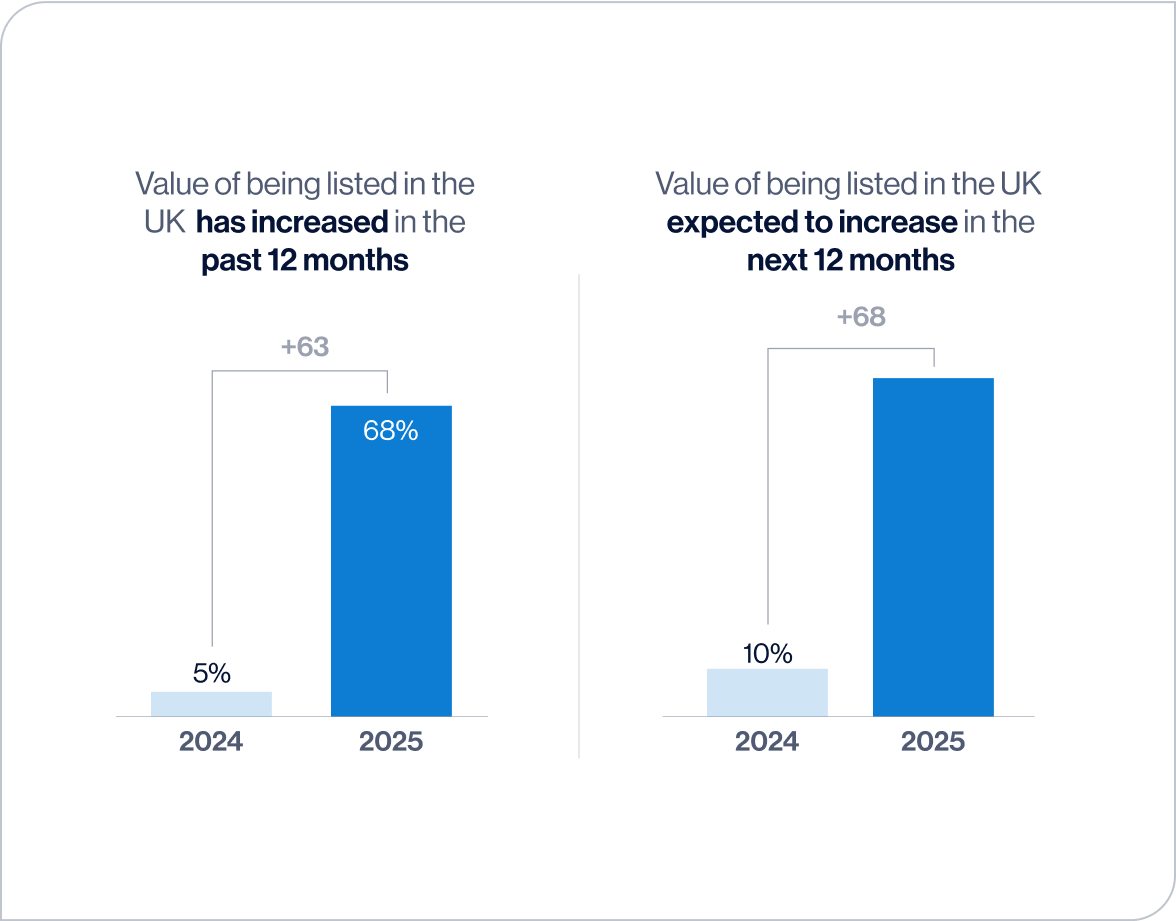

A significant shift in sentiment has occurred among UK CEOs, with a two-thirds majority (68%) now reporting that their companies derived value from listing domestically over the past 12 months. This represents a more than 13-fold increase from last year (5%). Looking ahead, 78% of UK CEOs are optimistic that the benefit of listing in the UK (versus listing in other markets) will extend into the next 12 months.

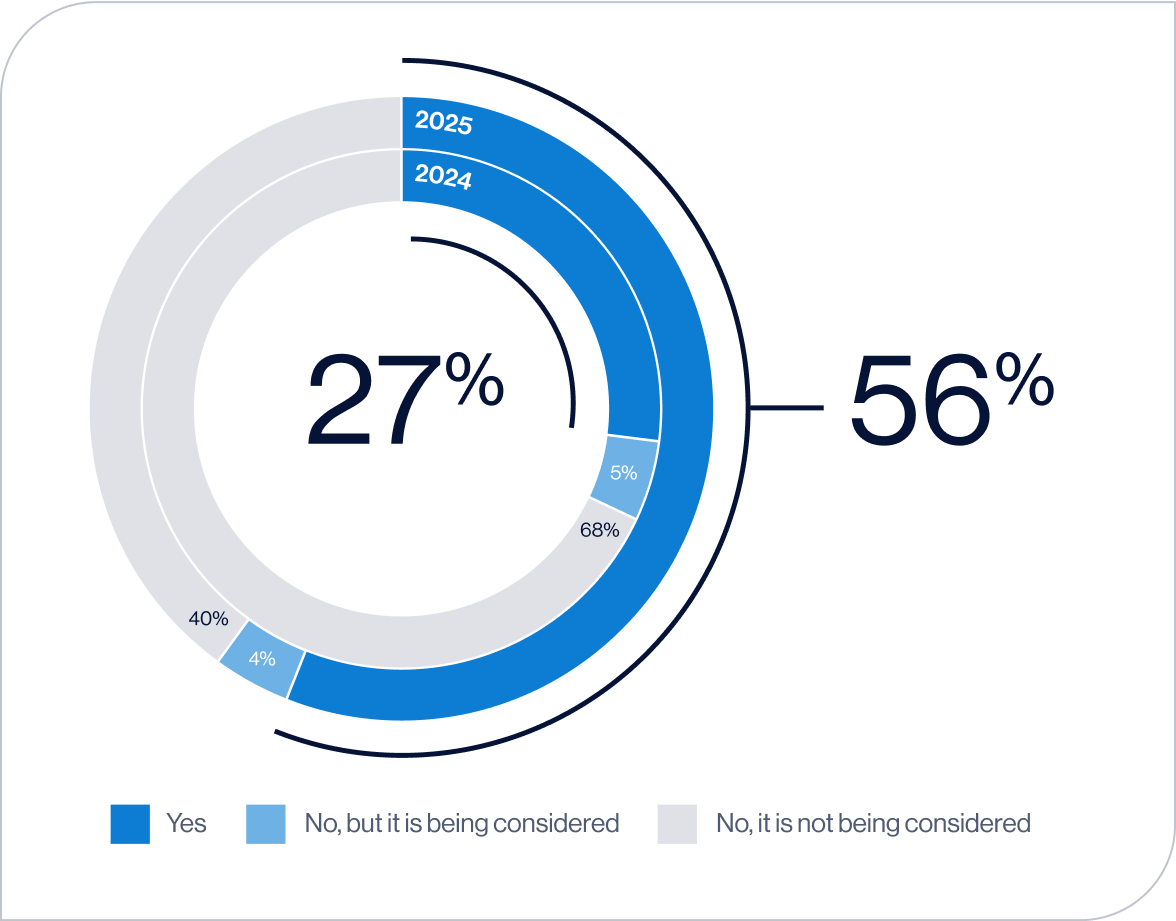

Despite this greater recognition of the benefit of listing in the UK – and while some may not choose to take action – the percentage of UK-based companies that have discussed moving their listing away from the UK market has doubled since last year (from 27% to 56%).

Question: Thinking about the past 12 months / next 12 months, do you feel the value your company gets from being listed in the UK vs. listing in other markets has increased or decreased / will increase or decrease?

Question: Have you had a discussion with your Board about the potential of moving your listing away from the UK market?