Innovation

Investment Plans for 2025

CEOs and investors align on AI as the leading technological priority for 2025, with nearly all survey respondents (97% of CEOs and 98% of investors) planning to maintain or increase AI investments.

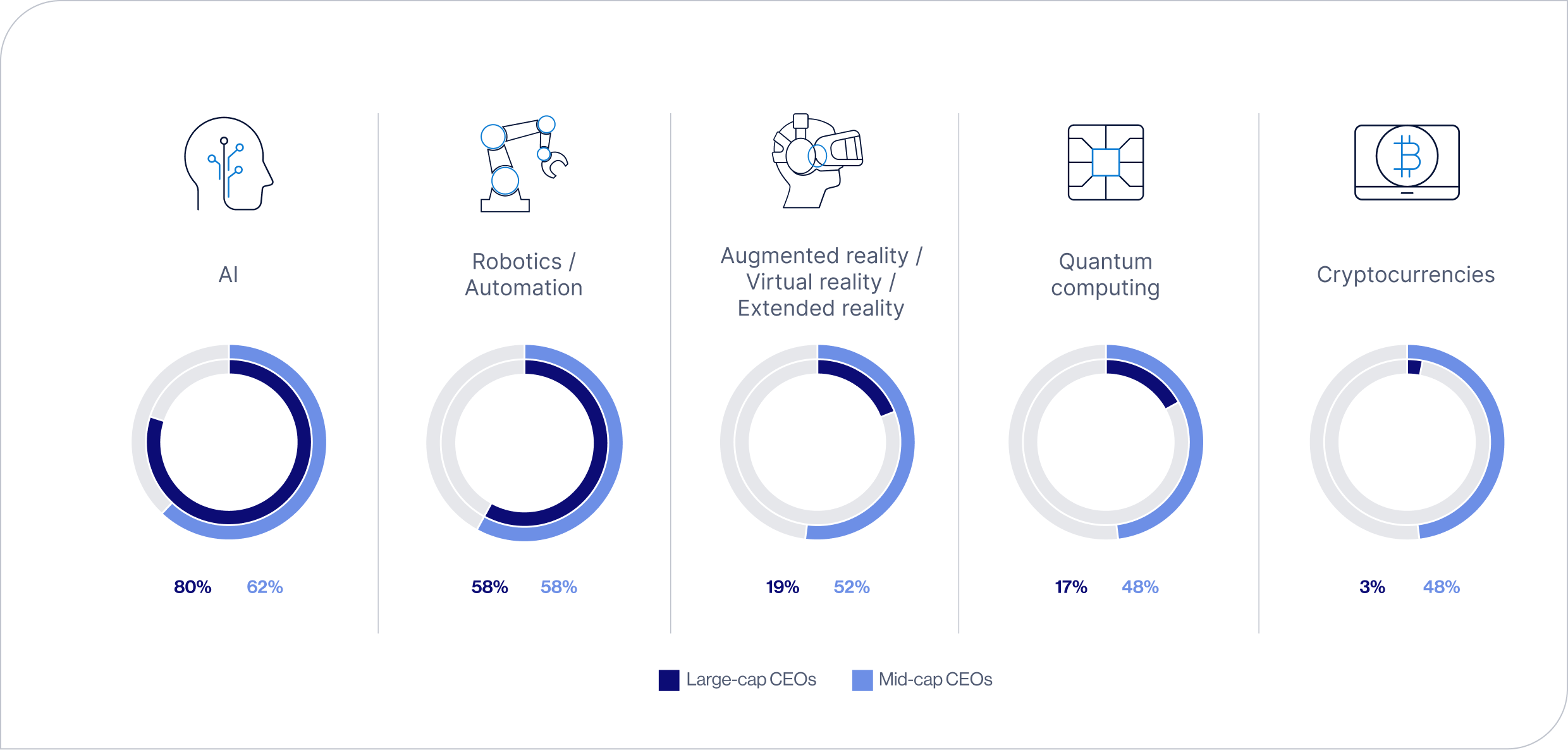

Overall, mid-cap CEOs and investors indicate a more balanced approach, diversifying technological investments across a broad range of emerging technologies alongside AI.

Meanwhile, large-company CEOs are fully committed to AI, leaving little room for other emerging technologies. Eighty percent of large-cap CEOs plan to accelerate AI spending in 2025, yet only 17% plan to increase spending in quantum computing and just 3% in crypto (compared to 48% of mid-cap CEOs and investors). This disconnect between the market and leading CEOs specifically around cryptocurrency – potentially driven by investors’ greater sophistication with distributed finance and the blockchain – risks setting up an expectation gap for large companies that have yet to develop their crypto strategies.

97% of CEOs and98% of Investorsplan to maintain or increase spending on AI in 2025.

Question: In 2025, will your company / do you believe leading corporations need to increase, maintain or decrease investment in each of the following technologies?

Leadership in AI Implementation

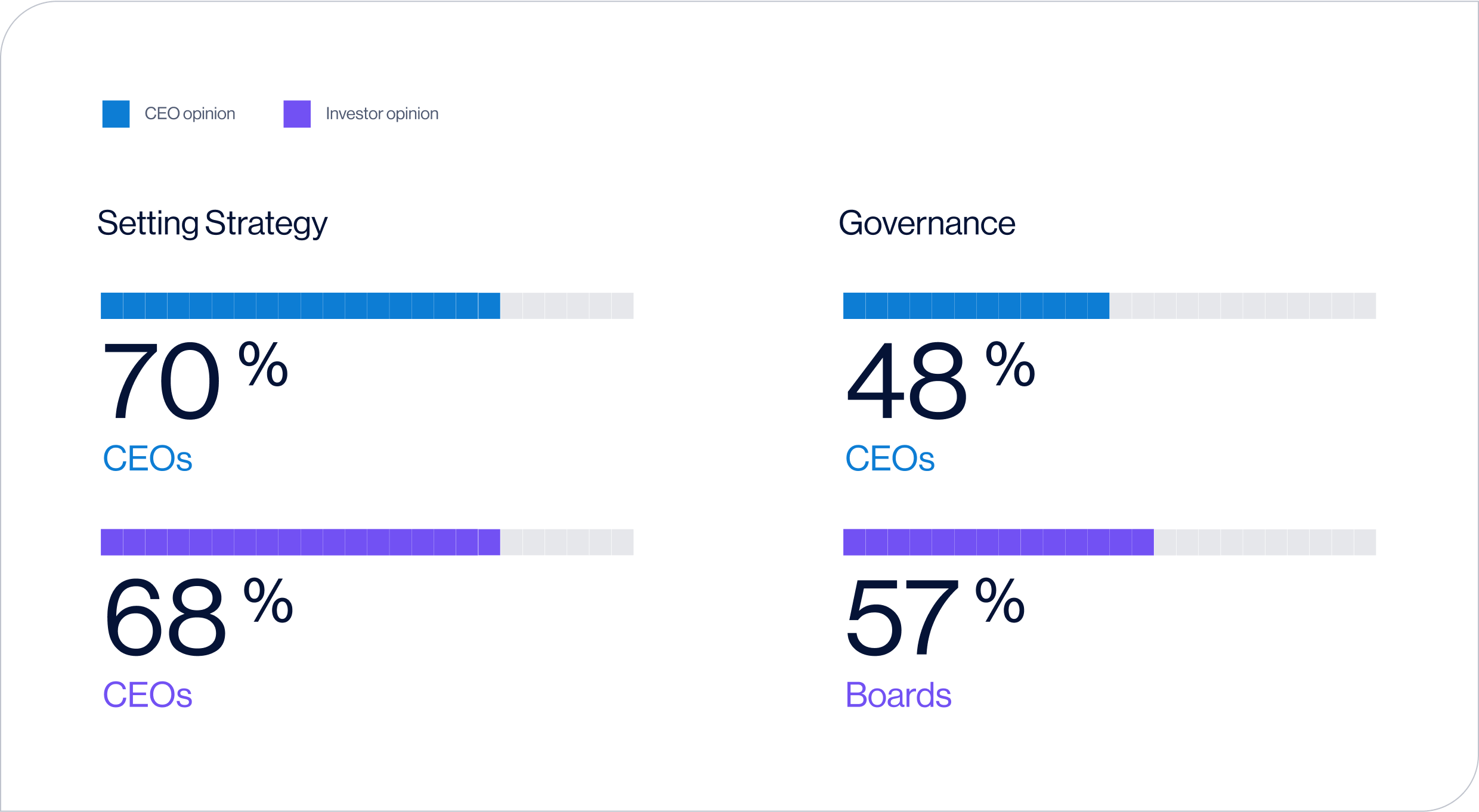

With substantial investment flowing into AI, strategic leadership is critical. CEOs are central in setting strategy (70%) and governance frameworks (48%) but rely heavily on CIOs and IT leaders to manage key aspects of AI implementations, including identifying use cases, vetting technologies, developing tools and upskilling the workforce.

Investors, however, express a desire for more top-down involvement from Boards and the broader C-suite in the implementation process. Without this, companies risk deploying AI initiatives that are misaligned with organizational strategy and Wall Street expectations.

Question: Who is / should be responsible for each of the following aspects of your / leading corporations’ AI implementation? (select all that apply)

ROI on AI Efforts

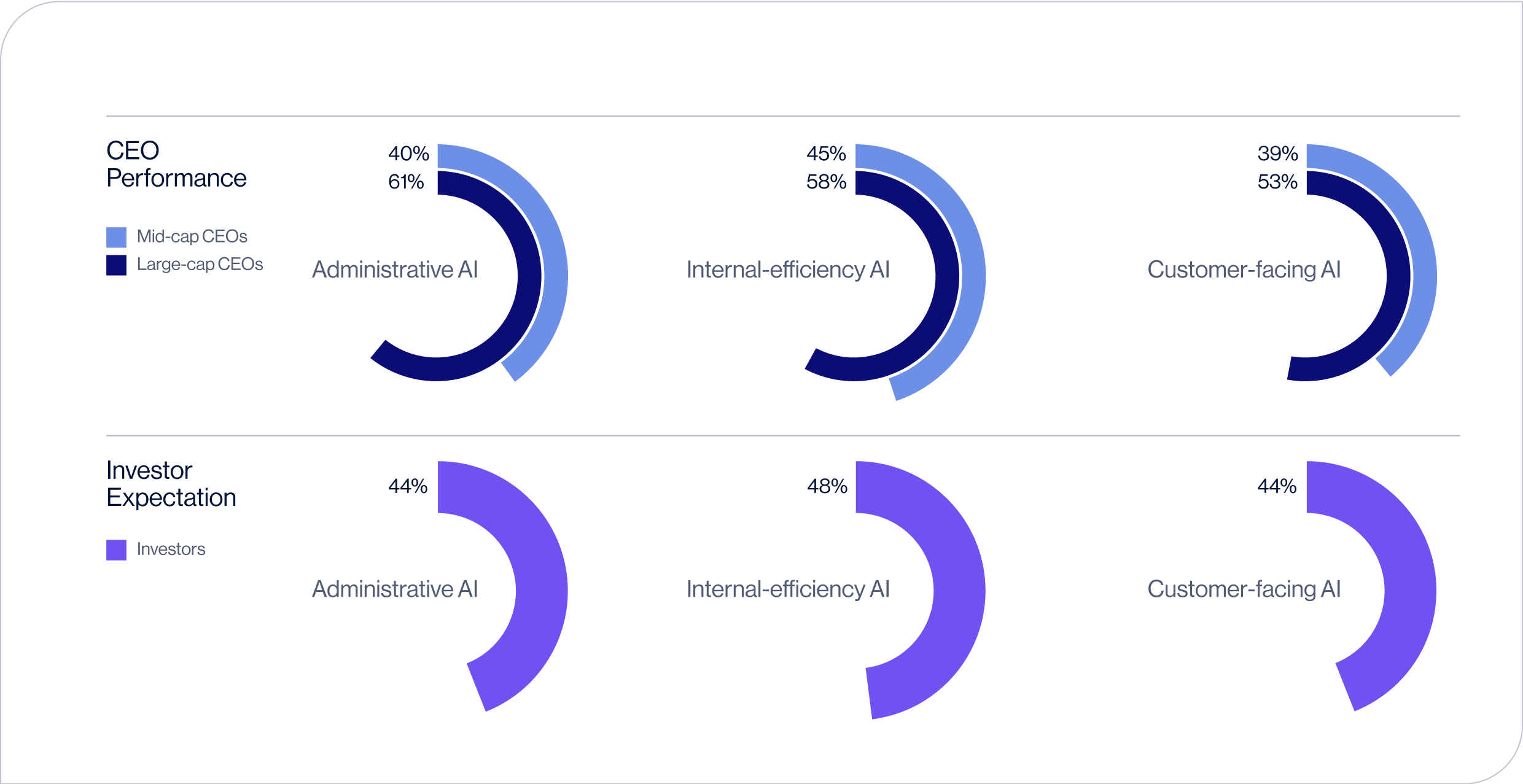

A little more than half of corporate America’s AI efforts are generating positive ROI. CEOs of large-cap companies report significantly higher percentages of ROI-positive AI initiatives compared to mid-cap counterparts. The profitability advantage is evident across internal efficiencies, operational improvements and customer-facing applications.

Question: What percentage of your AI projects / AI projects at leading corporations have delivered / do you believe have delivered a tangible ROI?

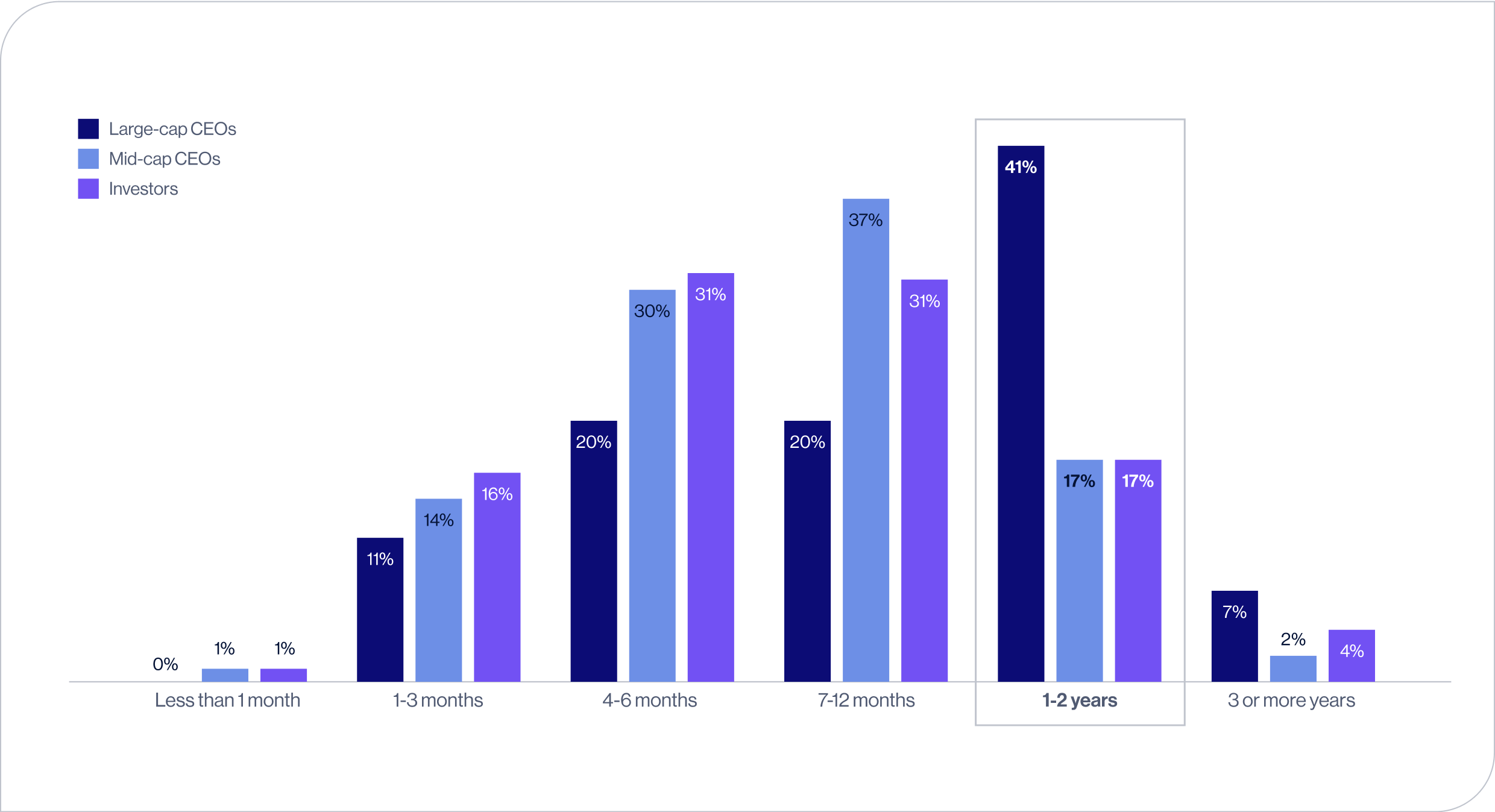

These results may be pressuring smaller companies and their investors to pursue faster AI wins. Notably, 82% of mid-cap companies and 79% of investors expect AI projects to deliver positive ROI within 12 months, while CEOs of large-cap companies (41%) are willing to let initiatives mature over 1-2 years before expecting positive results.

Businesses are faced with the challenge of balancing rapid ROI expectations with thoughtful scaling. Leaders and investors must carefully weigh immediate performance against the broader value of transformative AI capabilities, ensuring investments achieve both short-term results and long-term growth.

Question: For new AI initiatives, what is your timeline for expecting to see a positive ROI?