ESG

Balancing ESG Programs with the Core Business

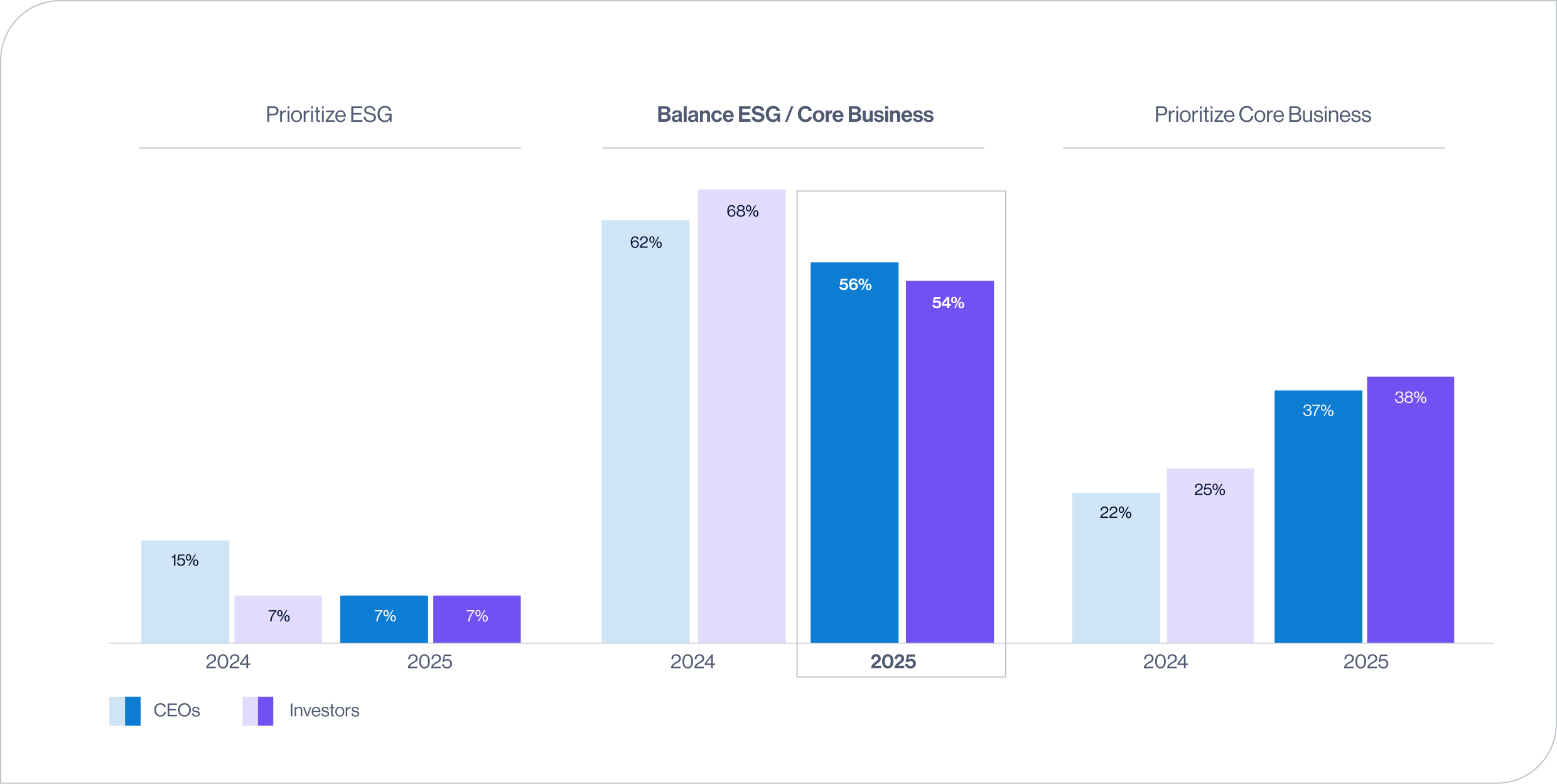

In the face of intensifying political and activist pressure on ESG issues – and in alignment with investor expectations – the majority of global CEOs (56%) remain committed to balancing ESG programs with the core business in the year ahead.

Compared to last year, there is a six-point decrease in CEOs and 14-point decrease in investors who are seeking this balance. The shift is not surprising, given the expected ESG-related policy changes addressed earlier in this report.

56% of CEOs and54% of Investorsplan to balance ESG programs with the core business in 2025.

Question: Looking ahead to 2025, how are you thinking / how should leading corporations think about your company’s / their investment in ESG-related activities relative to the core business?

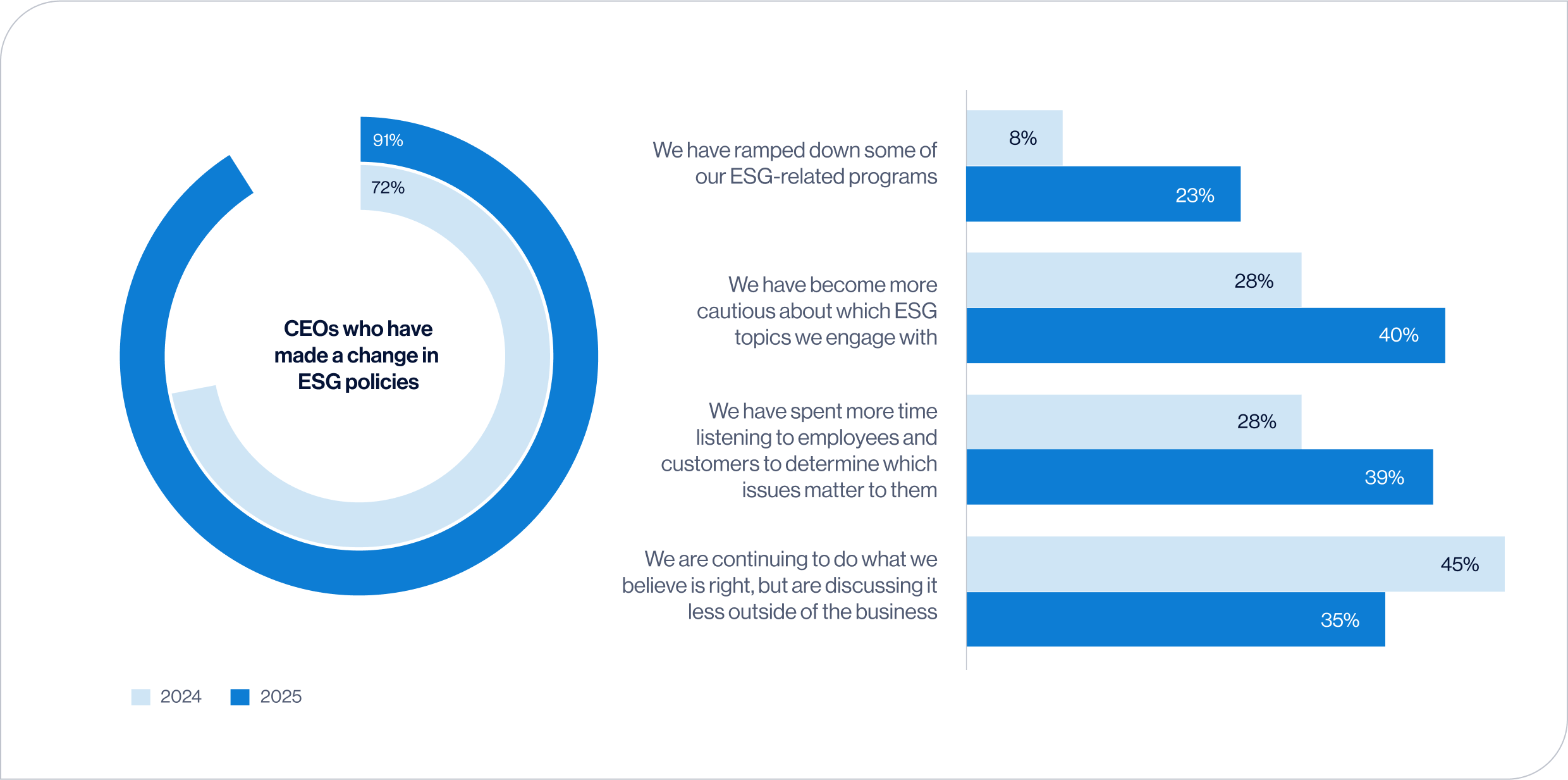

Recalibrating ESG Initiatives

Almost every CEO surveyed (91%, up from 72% in 2024) is recalibrating their ESG initiatives. Of those, 40% are exercising greater caution in selecting the issues or topics they engage with and 39% are spending more time listening to employees and customers to understand which issues matter most (a noticeable increase from 28% last year). More than one-third of CEOs are staying the course with what they believe is right but plan to discuss it less publicly. Almost one-fourth of CEOs are scaling back some programs, marking a significant increase from last year.

These actions generally align with expectations of investors who want to see a more cautious approach that involves deeper stakeholder engagement around continued ESG activities – a process that can be informed by regular materiality assessments.4

Question: How, if at all, has the politicization of ESG affected how your business operates? (select all that apply)

Recruiting and Retaining Diverse Talent

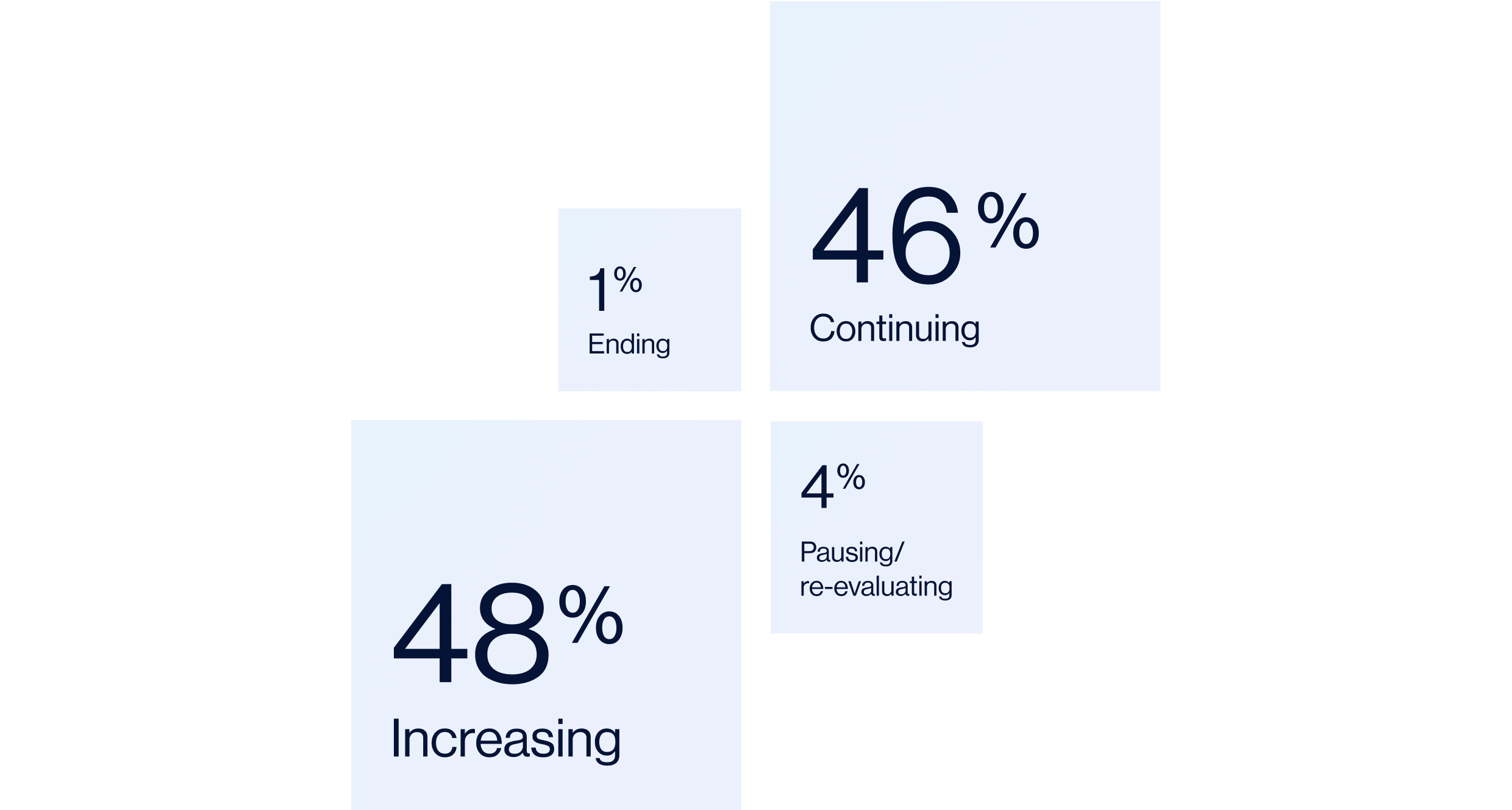

Amidst this charged environment, companies and investors are preparing for potential regulatory changes and / or new employment rules that may influence hiring practices in the year ahead. Nearly all CEOs globally (94%) indicate their intent to maintain or increase efforts to recruit and retain diverse talent while making necessary adjustments to comply with these possible regulations. This holds true even for U.S. CEOs (99%) who have faced particularly acute anti-DEI backlash.

0% of investors expressed a desire for companies to end DEI efforts.

Question: In light of the recent backlash against DEI, how – if at all – are you thinking about your business’ diversity, equity and inclusion (DEI) programs?

Achieving ESG Goals and Net-Zero Targets

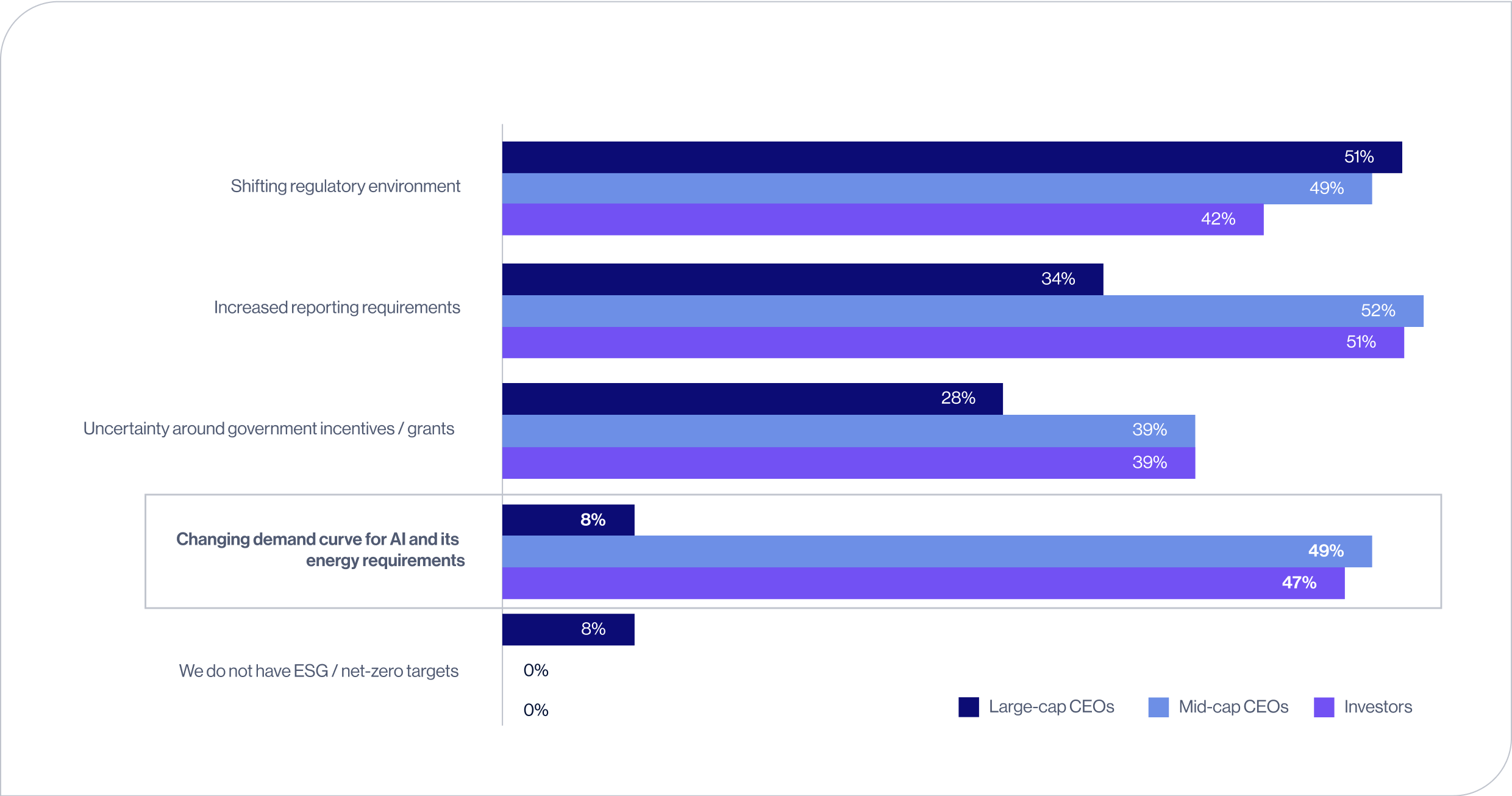

As CEOs and investors affirm their commitment to ESG programs and seek tangible progress toward their goals, they are navigating a number of significant hurdles, including a shifting regulatory environment, increased reporting requirements, uncertainty around government incentives and – more recently – the energy demands of AI adoption.

While investors generally seem to acknowledge the challenges, these complexities appear to apply disproportionate pressure on mid-cap companies compared to their large-cap counterparts, particularly regarding AI-related energy requirements.

Question: Which, if any, of the following are hindering your business’ / leading corporations’ ability to reach ESG goals / net-zero targets?