Geopolitics

Impact of 2024 Global Elections

The past year was filled with significant elections around the globe. In a wave of anti-incumbency fever, 2024 elections led to changes in government, an influx of powerful populists and high fragmentation in Western democracies.

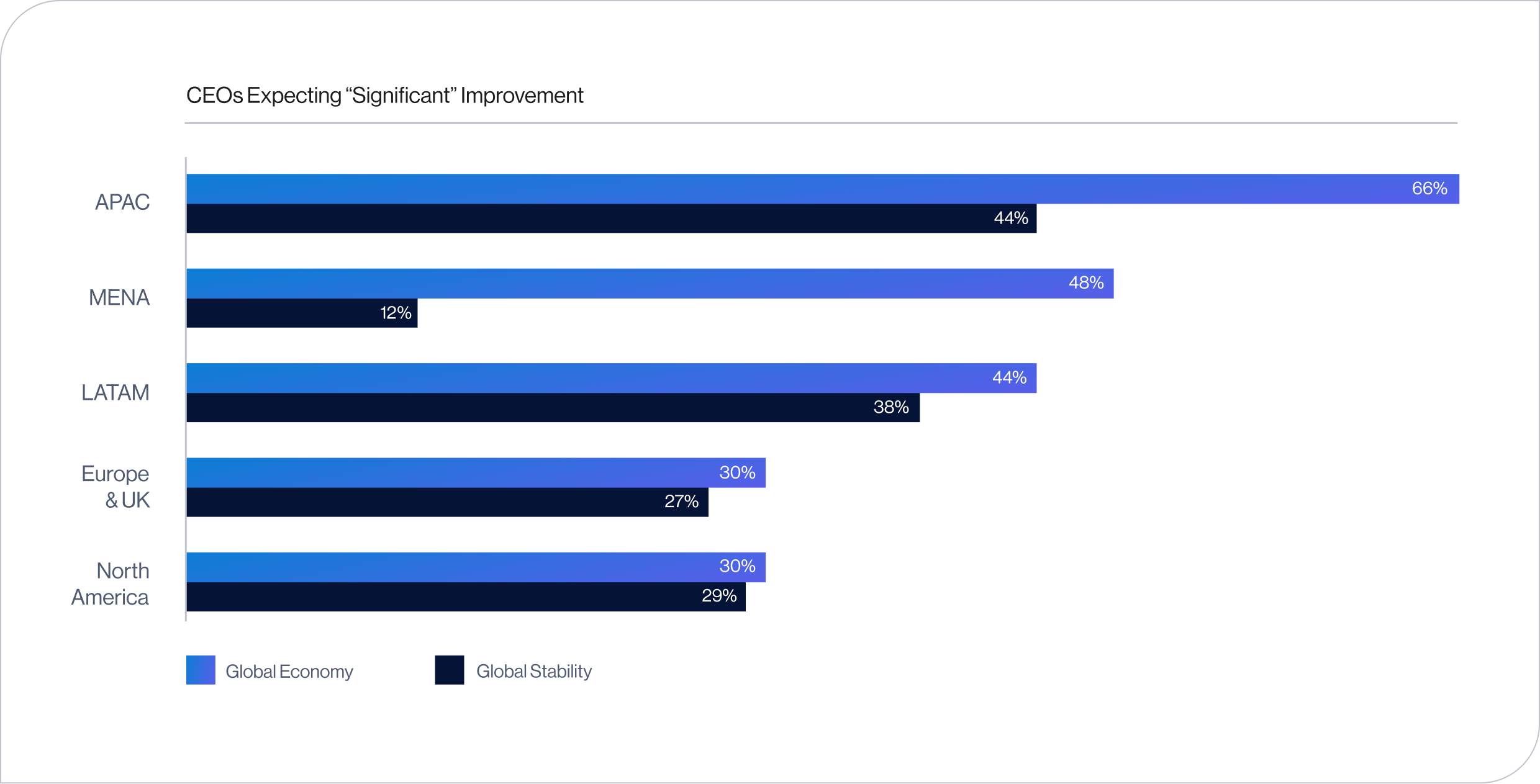

Despite these unprecedented and disruptive outcomes, more than 76% of CEOs and 83% of investors believe that 2024 election outcomes will improve the global economy and global stability.

Interestingly, the perspectives of CEOs anticipating “significant improvement” in 2025 diverges by region. For instance, CEOs from APAC exhibit the highest optimism about the global economy (66%), but are less confident on global stability (44%). Meanwhile, CEOs from the Middle East and North Africa (MENA) region are somewhat optimistic about prospects for the global economy (48%), but regional conflict has them nervous about global stability (12%).

Question: What impact, if any, do you believe the outcomes of the range of global elections in 2024 will have on:

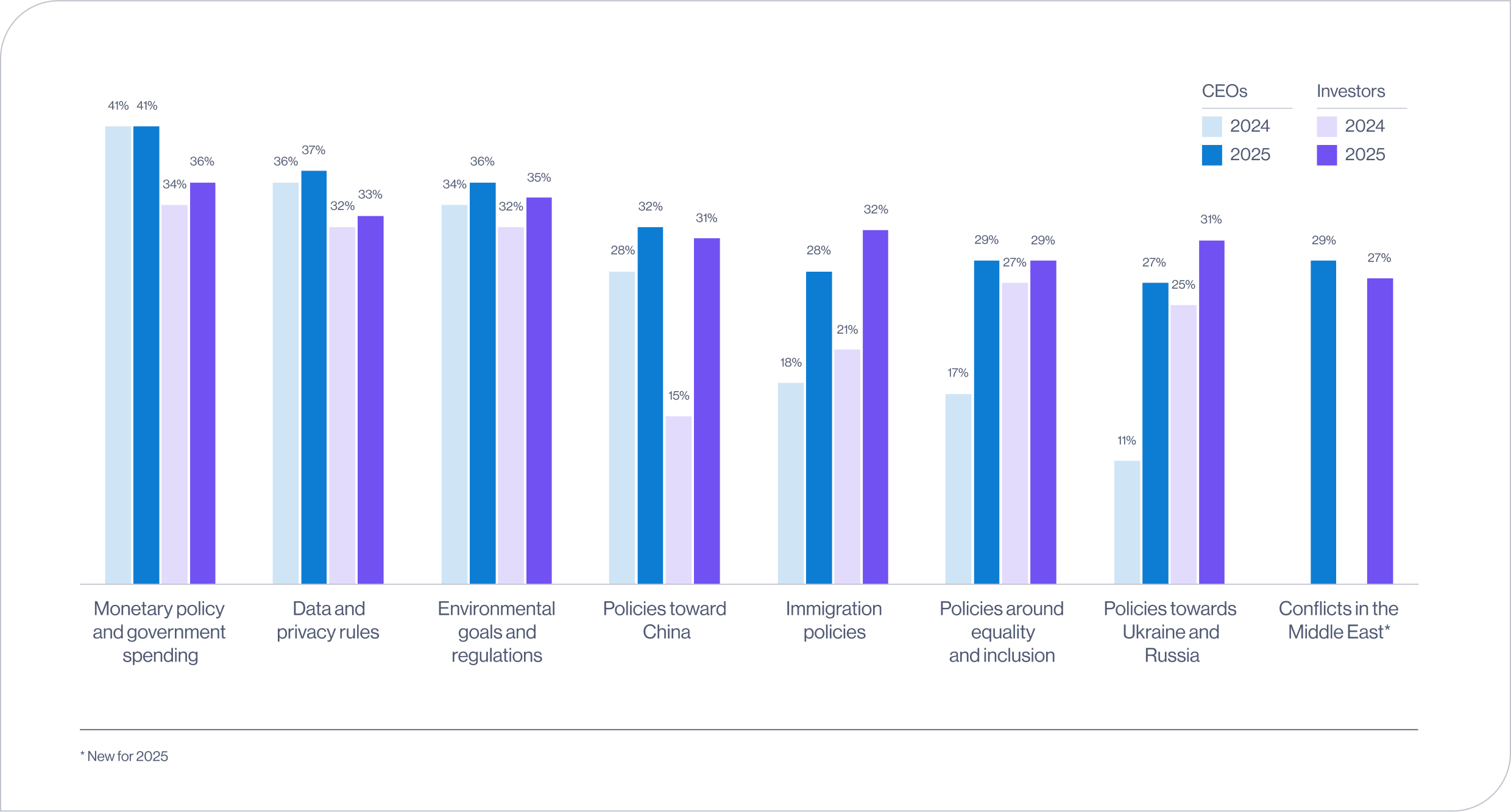

CEOs and investors both indicate that policy changes related to monetary policy and government spending would have the greatest negative impact on their business in 2025.

Compared to last year, there are noticeable jumps in the percentages of global CEOs who are concerned about negative impacts of policy changes related to immigration, equality and inclusion, and Russia / Ukraine.

CEOs and investors are equally monitoring developments in the Middle East, where capital is freely flowing through Gulf Cooperation Council (GCC) countries,3 while others are roiled in geopolitical conflict.

Question: Thinking about the impacts of this year’s elections around the world and the possibility of sudden shifts in policy and regulatory policies, which of the following policy disruptions would have the biggest negative impact on your business / leading corporations? (select all that apply)

Disruption in 2025

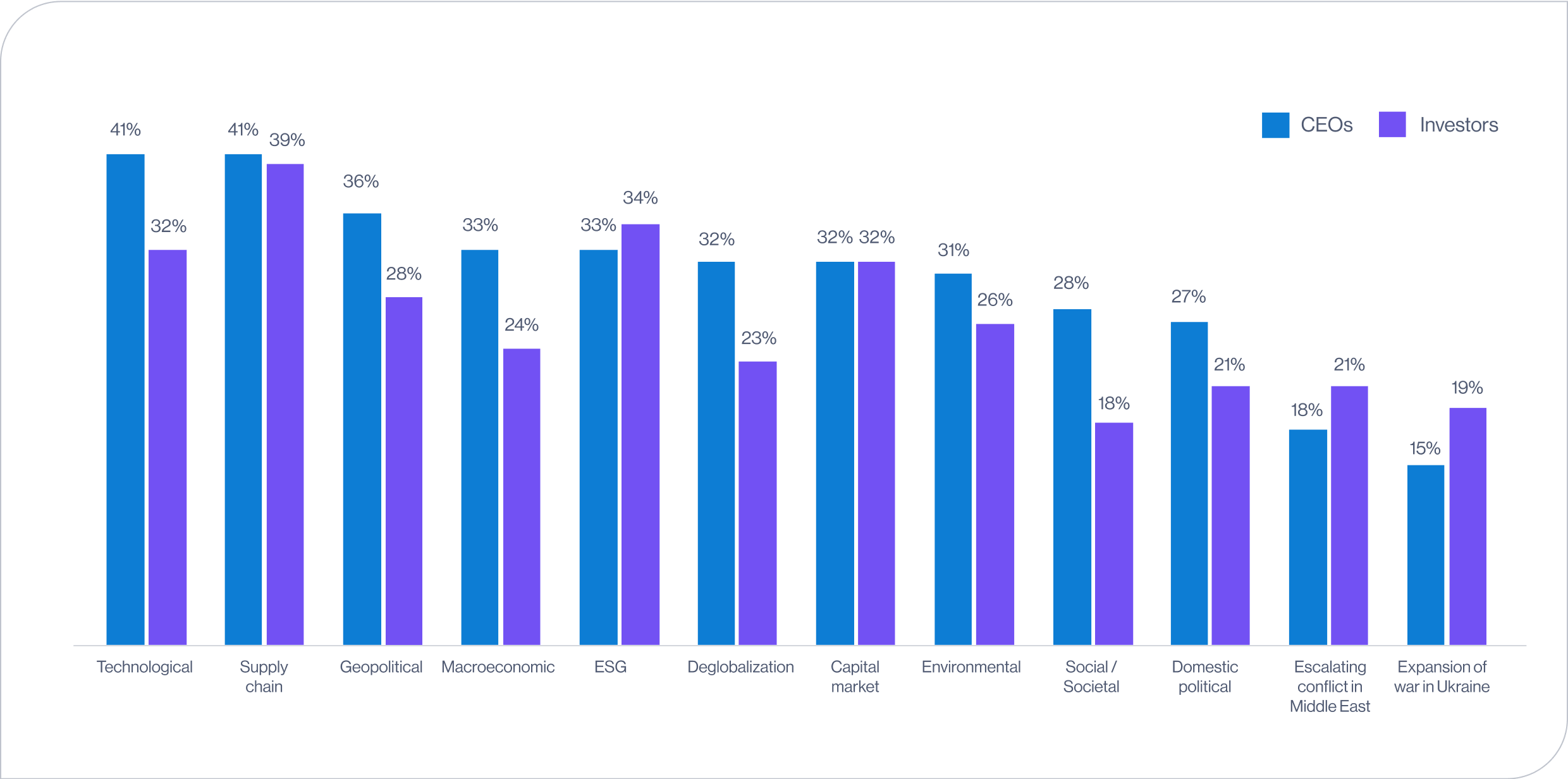

In addition to potentially disruptive policy changes, CEOs and investors continue to monitor a broader range of possible risks for 2025, with technology and supply chain issues at the forefront (Figure 14).

Nonetheless, survey respondents appear to be overwhelmingly confident (84% of CEOs and 82% of investors) in their ability to address these challenges based on preparations undertaken in 2024. It is worth noting that this level of confidence appears to dip slightly for CEOs (70%) when it comes to addressing environmental / climate disruption, expansion of the war in Ukraine and escalating conflict in the Middle East.

More than 67% of CEOs and investors are confident that businesses are prepared to handle various types of disruption in 2025.

Question: In which of the following areas is your business / are you preparing for further disruption in 2025? (select all that apply)

Deglobalization

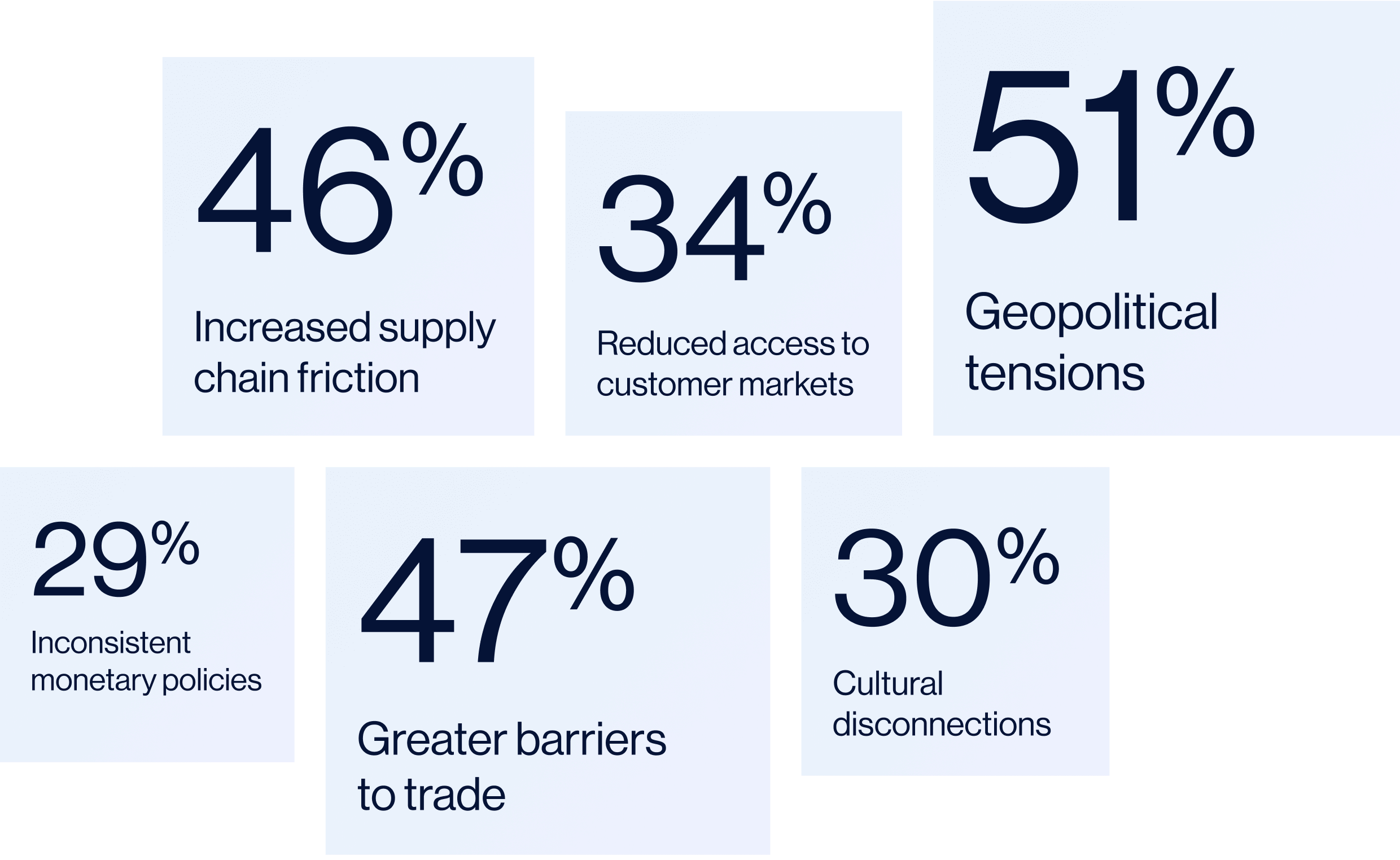

CEOs and investors agree that deglobalization has already begun and / or will happen in the future. While survey respondents are somewhat mixed on the exact timing, virtually all (98% of CEOs and 97% of investors) are concerned about the impact of deglobalization across a range of factors. CEOs appear to have disproportionately stronger concerns about the impact of geopolitical tensions (51%) and increased supply chain friction (46%), while CEOs and investors share mutual concern around greater barriers to trade (47% and 46%, respectively).

Despite these worries, 78% of both CEOs and investors note that they are somewhat or very confident that – based on preparations made in 2024 – businesses are in a strong position to handle the effects of deglobalization.

78% of CEOs and investors are confident that businesses are in a strong position to address the effects of deglobalization.

Question: Which of the following aspects of deglobalization are you most concerned about? (select all that apply)

Importance of China

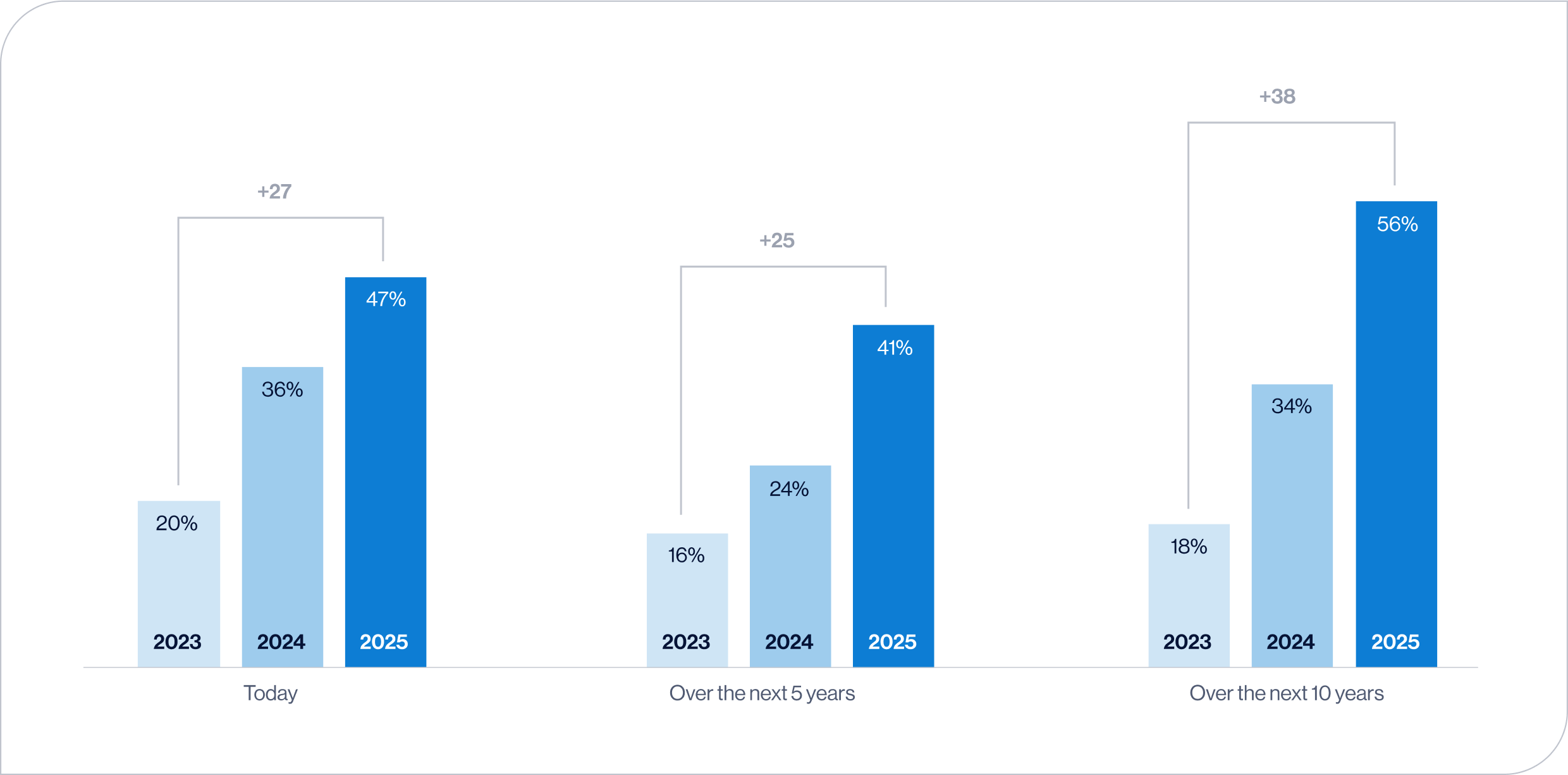

China remains a high priority for investors despite economic challenges and slowing GDP growth. However, for the first time since this survey’s initial 2023 benchmark, CEOs now align with investors on this point. Compared to two years ago, the percentage of CEOs indicating that China is important to their corporate strategy has more than doubled across the board.

CEOs may be responding to China’s growing influence in strategic industries of the future, including clean energy, electric vehicles and industrial robots. At the same time, some companies are preparing to shift supply chains out of China amidst expectations that anti-China protectionism will increase in the coming years.

More than 48% of investors over the past three years have consistently indicated that China is important to their business strategy.

Question: How important is China to your business / investment strategy...