Deglobalization

Deglobalization is an important long-term trend. Indeed, two-thirds of CEOs and investors agree that 2024 will see a continuing push toward deglobalization.

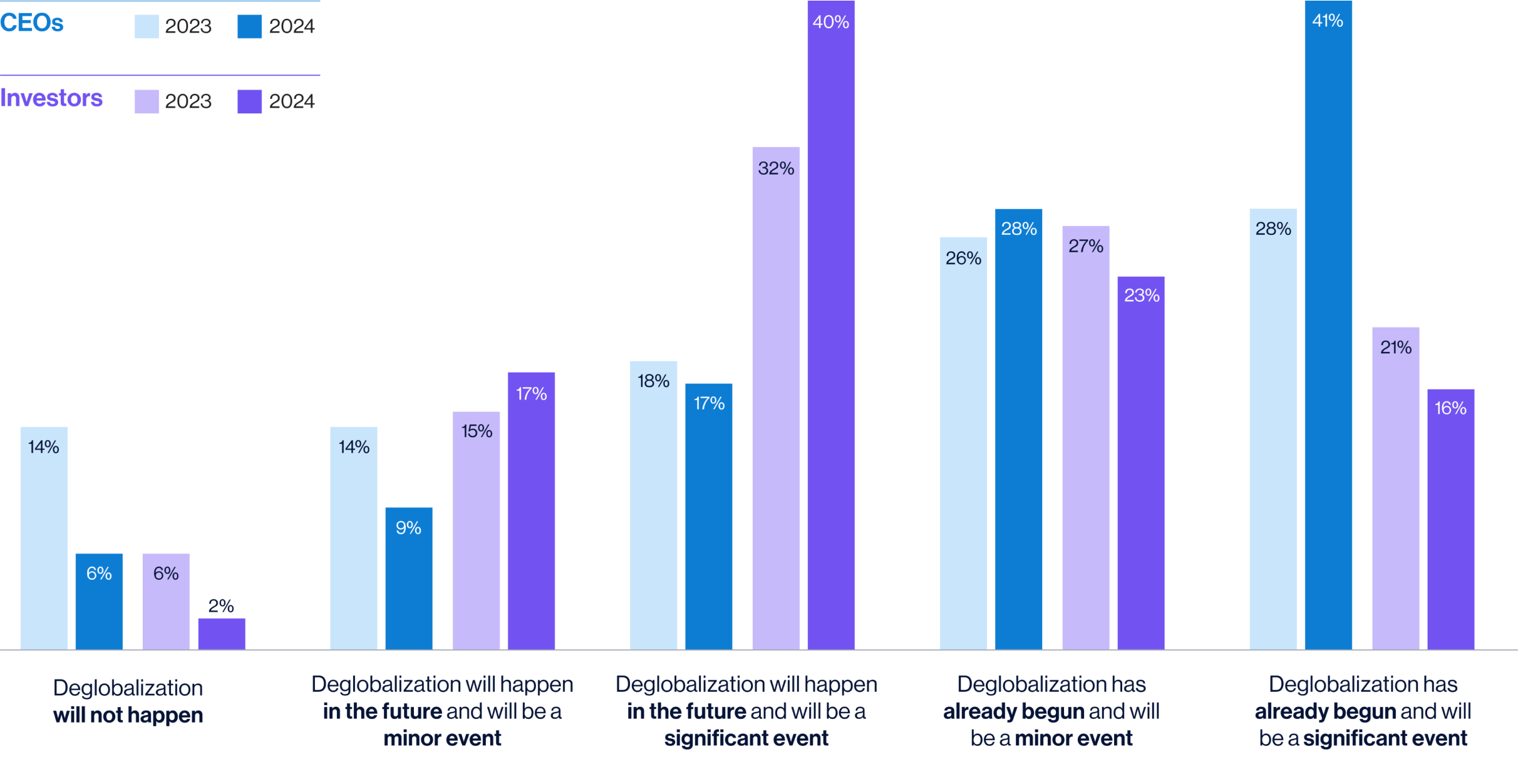

However, responses are split over whether the most significant impacts of deglobalization have already begun (69% of CEOs) or will happen in the future (57% of investors), suggesting that deglobalization may yet be more of a “process” than an “event.” CEO responses may also reflect that businesses have already implemented significant changes in response to deglobalization (see Figure 8), while investors are still waiting to see how those bets pay off with regard to margins and profitability.

69% of CEOs believe the most significant impacts of deglobalization are already underway

Question: Which of the following is closest to your own view about the potential for deglobalization?

57% of investors believe the most significant impacts of deglobalization are yet to come

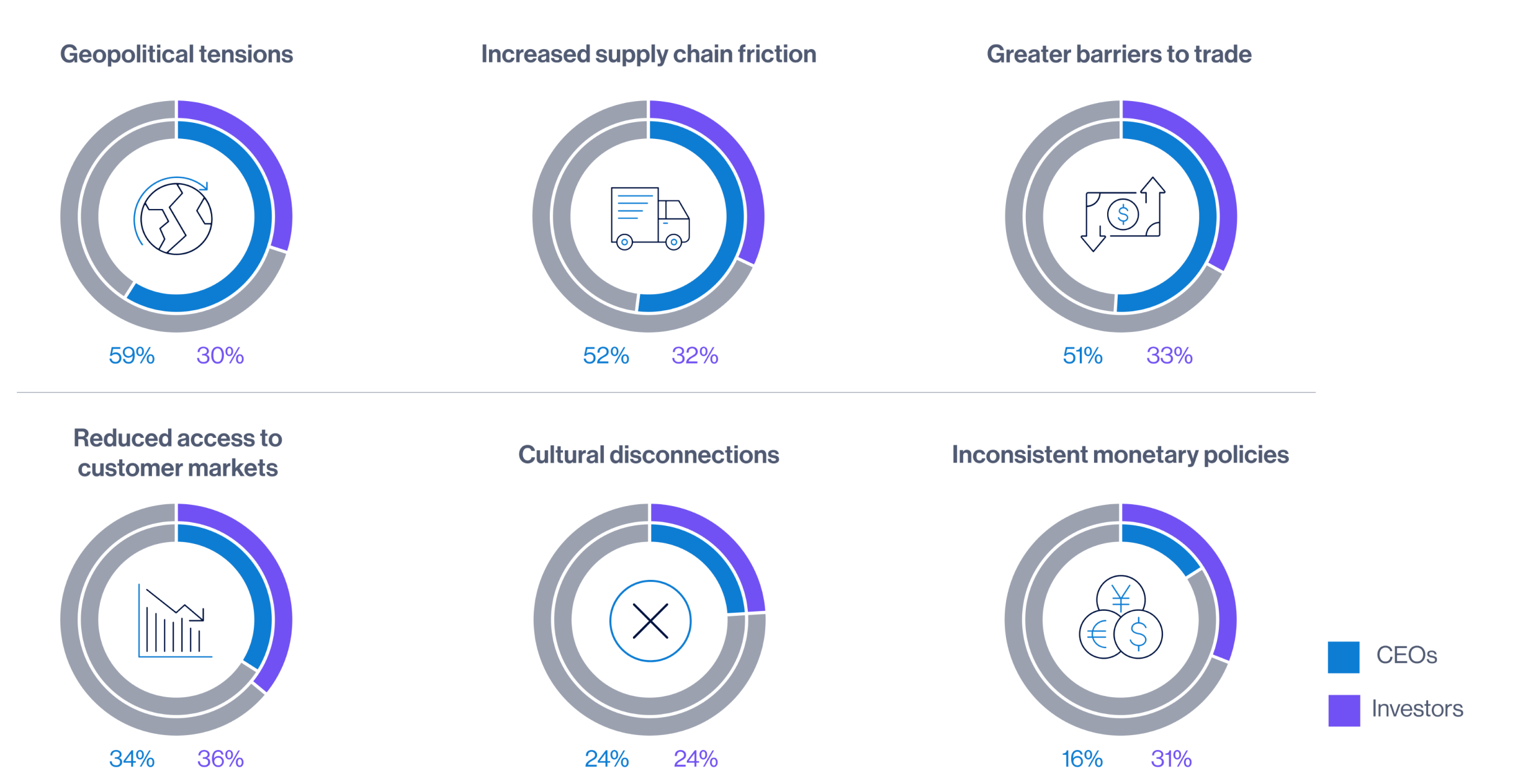

Investors are focused on several aspects of deglobalization. CEOs appear to see deglobalization risks mostly on the supply side (effects on production changes and global exchange of goods) but less on the demand side (market access, cultural factors, monetary policy).

With almost 60% of CEOs acknowledging concerns over geopolitical tensions in terms of deglobalization, it raises questions about whether CEOs see geopolitical tensions as a driver of deglobalization, an impact of deglobalization, or both.

Question: Which of the following aspects of deglobalization are you most concerned about? (select all that apply)

One in five CEOs report that they are not making any adjustments to their business in 2024 to account for deglobalization, indicating that necessary preparations may have already been made and that companies have adapted to the new reality.

For the majority of companies that are still retooling, the focus is on the supply side. Almost 50% of CEOs are looking to make their supply chains more resilient; however, only 24% are planning to re-locate physical operations in 2024. One lesson may be that companies are pursuing supply chain rationalization, without wholesale abandoning China and other markets. Companies may also find that alternative providers for manufacturing and sourcing present risks of their own. Finally, while the geopolitical tensions noted in Figure 7 may be pushing some companies out of China and other markets, ambitious policies such as the Inflation Reduction Act and the CHIPS Act in the U.S. are promoting both onshoring and “friendshoring.”

Question: How, if at all, is your business adjusting / should leading corporations adjust to the potential for deglobalization?

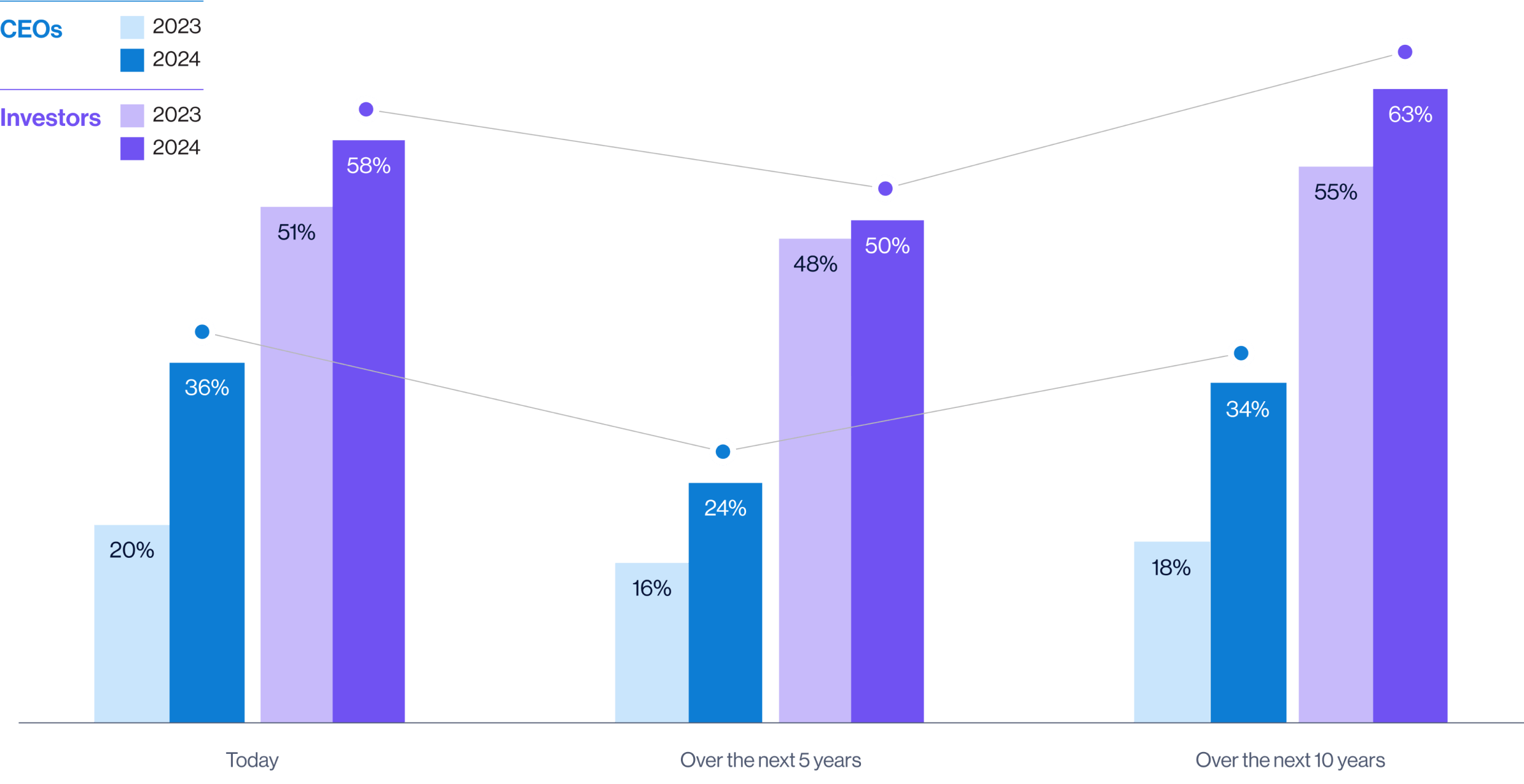

With the end of China’s “zero-COVID” policy in January 2023, the strategic importance of China rebounded for both CEOs and investors over the past 12 months. What’s more, 34% of CEOs (up from just 18% last year) and 63% of investors (up from 55% last year) report that China is important to their strategy over the next 10 years. To put it another way, headlines about companies decoupling from China may be overstated.

The U-shaped curve in responses is an indicator that most CEOs and investors have a positive view of opportunities in China today – and remain committed to the China market for the long-term. However, the dip at the five-year mark indicates that a fair measure of uncertainty remains about the challenges ahead, especially if the Chinese economy hits a speed bump and geopolitical tensions remain high.

Question: How important is China to your business / investment strategy…