Russian and Ukrainian delegations will resume their talks. Hungarians are going to the polls. Ethiopia has declared a humanitarian truce for the Tigray region.

Meanwhile, a two-stage lockdown has been announced in the Chinese city of Shanghai, incumbents are expected to fare well in the Serbian elections, executive-legislative tensions have reached new heights in Ecuador, and the South African Reserve Bank has raised the repo rate.

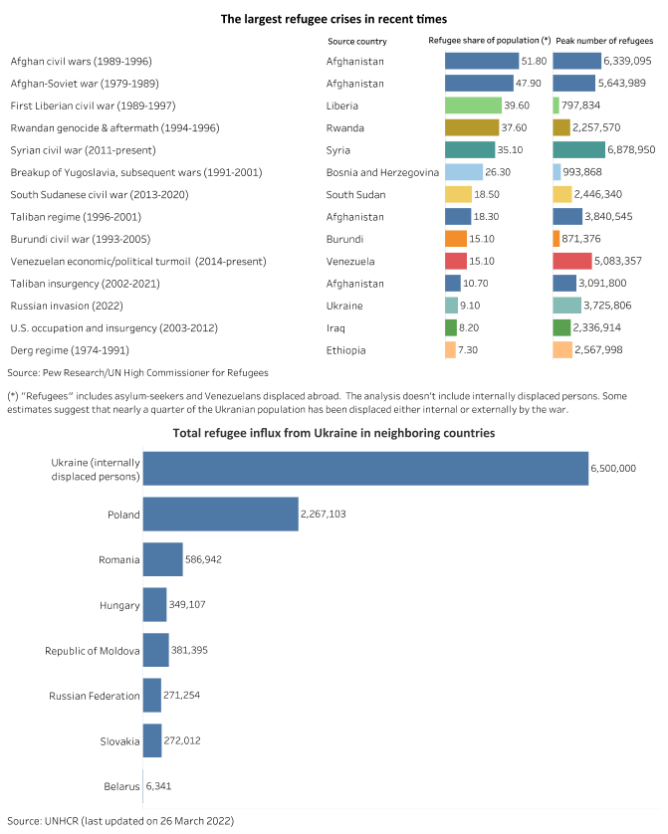

Chart of the Week

EU interior ministers will gather on 28 March for an extraordinary meeting to discuss measures to support the growing number of refugees fleeing Ukraine. EU countries have so far been more united on the migration front than in previous crises. The 2001 EU temporary protection directive, which was designed in response to the 1999-99 Kosovo war, has been activated for the first time, which gives refugees a residence permit – for up to three years – and access to employment and social welfare. However, even if refugee inflows have been less politically difficult than in the 2015 migration crisis, challenges lie ahead for member states and EU institutions. Data collected by the UN High Commissioner for Refugees suggests that in only one month, more than 10mn people have been displaced – 6.5mn inside Ukraine and 3.7mn people have fled their country. Meanwhile, Eastern European countries will require major financial and logistics support from the EU to host a growing number of refugees.

What to Watch

Russia/Ukraine

Ukrainian and Russian delegations will resume in-person negotiations scheduled for 29-30 March in Istanbul, Turkey. While the two sides appear to be making some progress on Russia’s demands for Ukraine’s neutrality, demilitarization, and “denazification”, their positions on the status of the self-proclaimed republics in Donbas and Crimea remain far apart. Also, it is hard to see how Kyiv’s calls for security guarantees from other countries can be agreed without their participation in the talks. The Russian side rejects Ukrainian President Volodymyr Zelensky’s calls for direct negotiations with President Vladimir Putin at least until there is “clarity” on all key issues. In the meantime,Moscow will likely continue air strikes across Ukraine despite claims of focusing on taking full control of the Luhansk and Donetsk regions.

Hungary

An electoral alliance led by the ruling Fidesz will likely win the 3 April general election and secure an absolute majority of mandates in the 199-seat parliament. However, Prime Minister Viktor Orban’s delicate efforts to limit potential electoral losses from his longstanding relations with Moscow leave some room for uncertainty. The united opposition alliance United for Hungary (EM) presents the greatest electoral challenge for Orban since 2010. The next government will have to deal with a raft of challenges associated with slowing economic growth, soaring inflation, fiscal problems caused by significant pre-election spending and tax breaks, not to mention persisting security threats and hundreds of thousands of refugees entering the country from Ukraine. Continued Fidesz rule would mean persisting tensions between Budapest and Brussels over the rule of law and public procurement issues, although the war in Ukraine and its consequences could give both sides more space for reaching a compromise.

Ethiopia

On 24 March, Prime Minister Abiy Ahmed’s government declared an “indefinite humanitarian truce” and promised to allow aid into the embattled, famine-stricken Tigray region. In response, the Tigray People’s Liberation Front (TPLF) signaled its willingness to observe the truce if Tigray received aid “commensurate with needs” and “within a reasonable timeframe.” However, the only viable aid corridor runs through the Afar region, where the TPLF has been fighting in at least six districts. Humanitarian aid flows will be crucial to avert a deepening famine; stave off sanctions, especially from the US; facilitate debt restructuring; and perhaps eventually pave the way for ceasefire negotiations.

On the Horizon

ASIA PACIFIC

China

The government of Shanghai announced a two-stage mass lockdown and testing campaign. Each half of the city will be shut down successively from 28 March to 1 April and 1 to 5 April. Factories will suspend production and office employees must work from home. The city reported 2,678 cases on 26 March, its highest ever single-day tally.

EUROPE

Italy

Former Prime Minister Giuseppe Conte is expected to be re-elected as leader of the Five Star Movement (M5S)after a court ruling said the previous election was illegitimate. The only unknown in the online vote that will end late on 28 March is the turnout. In a desperate move aimed at gaining visibility ahead of the vote, Conte has made noise recently about the M5S’ opposition to an increase in military spending. He did so after PM Mario Draghi stated that he plans to increase military spending by 2% of GDP. However, Draghi is unlikely to lose sleep over Conte’s threat.

Serbia

Incumbents are set to claim convincing victories in the presidential and parliamentary elections scheduled for Sunday, 3 April. President Aleksandar Vucic will likely secure his second five-year term in office, possibly already in the first-round vote, while an electoral alliance led by Vucic’s Serbian Progressive Party (SNS) is on track to win an absolute majority of mandates in parliament. The expected result reaffirms the continued dominance of SNS and Vucic. This will lead to continuity in most areas, including multi-dimensional foreign policy and slow progress on tackling high-profile corruption and reforming state-owned enterprises. Slow reforms along with the unresolved conflict with Kosovo, as well as Belgrade’s reluctance to join the EU sanctions on Russia, will limit its EU accession prospects for the foreseeable future.

LATIN AMERICA

Brazil

The official “party window” when politicians can freely change parties before upcoming elections will end on Friday, 1 April. The Liberal Party (PL) from the pragmatic “Big Center” (a block of parties known for indiscriminately supporting governments in power) was the main beneficiary in the period, having become the biggest party in the House after increasing its number of seats from 33 to 65 representatives. The increase was due to the migration of pro-Bolsonaro representatives from the social liberals (PSL) - the party with which the president was elected in 2018 but left in 2019 - following the president’s affiliation to the PL. On another front, Congress may delay once again the analysis of presidential vetoes, which is scheduled for 28 March and should include aspects of the 2022 annual budget law.

Ecuador

Executive-legislative tensions have reached new heights since the National Assembly voted down President Guillermo Lasso’s investment promotion bill on 24 March. Lasso subsequently accused several legislators from the indigenous Pachakutik (PK) party of demanding political pork and other incentives in exchange for their votes. Lasso has also gone on the offensive against the Democratic Left (ID)’s 2021 presidential candidate, Xavier Hervas, by requesting a tax investigation against him. Votes from both the PK and ID are necessary for legislative majorities. These moves have increased speculation that Lasso could be considering triggering the constitution’s “mutual death” (“muerte cruzada”) clause. This would see the National Assembly dissolved and new elections organized for both president and legislature within 90 days. The clause has never been invoked before.

MIDDLE EAST AND AFRICA

South Africa

The South African Reserve Bank (SARB) on 24 March raised the repo rate by 25 basis points. However, the fact that two monetary policy committee (MPC) members favored a steeper hike signals growing MPC readiness to tighten policy amid the global fallout from the Ukraine crisis. Ahead of the next MPC meeting in May, the SARB will be scrutinized for its resolve to target the mid-point of its 3%-6% inflation targeting range. It had also begun to advocate for a lowering of the target – a position that could become controversial amid the Ukraine fallout and domestic political convulsions ahead of ruling party conferences due in July and December.