Japan will hold Upper House elections. Germany is preparing for Russia halting gas deliveries.

Meanwhile, smaller Covid outbreaks have occurred in China, Russia is mobilizing the economy for sustained war, Chile’s new constitution has been formally delivered to the president, and IMF representatives are expected to arrive in Ghana.

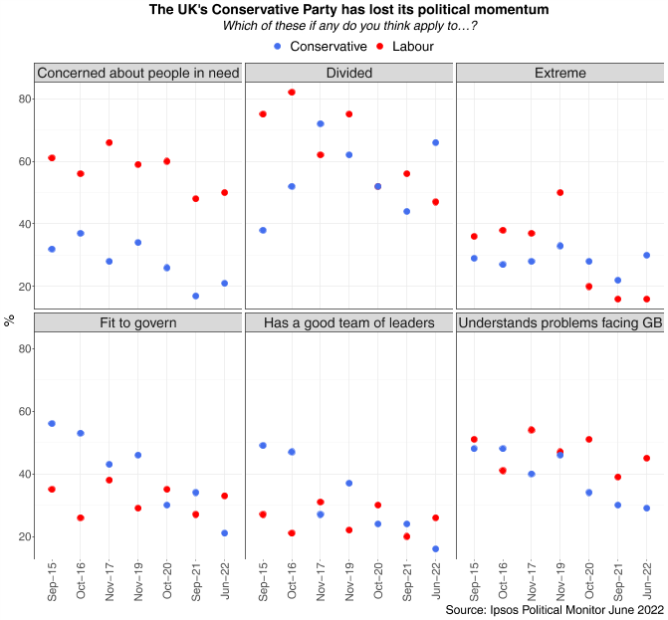

Chart of the Week

The British Conservative Party is facing some of its most difficult months since arriving to power twelve years ago. Public opinion surveys show that only around 20% of Britons believe that the Tories are fit to govern, while 16% consider that this party has a good team of leaders. These figures are particularly striking if compared to David Cameron’s government in 2015. Back then, these numbers stood at almost 60% and around 50%, respectively. Although Britons today are more positive about Labour being “fit to govern” and its leadership, these figures are not particularly good either. Two questions emerge from these trends. The first is whether the Tories, possibly under a new leadership, will be able to recover some political momentum in the next two years. The second is about Labour’s ability, under Sir Keir Starmer’s more centrist leadership, to benefit from the Conservatives’ travails. The current cost-of-living crisis, an autumn of strikes, and a likely energy price rise in the winter will all leave their mark on the UK’s medium-term political trajectory.

What to Watch

Japan

Despite voter disquiet about inflation and a weak yen, the Upper House elections on 11 July are set to see another solid victory for the ruling LDP-Komeito coalition. With half of the seats in the chamber being contested, a simple majority would pave the way for the government to maintain stable control of the Diet legislative process for up to three years. Amending the Constitution’s Article 9 peace clause may also be on the agenda in the coming months if the LDP and other pro-revision parties secure a two-thirds supermajority.

Germany

Nord Stream 1 gas deliveries from Russia will come to a halt at the end of this week. As of 11 July, annual maintenance works will be carried out on the pipeline, which usually take around ten days. However, the fear is that Moscow will keep deliveries interrupted beyond the scheduled break. In the meantime, the government is racing to get a new EEG-style surcharge through parliament before the end of the week, shielding utilities from the elevated cost of gas. The goal is to prevent a repetition of the current situation at Uniper which is expected to be bailed out via a mix of loans from public infrastructure bank KfW and the state potentially taking a share in the company.

On the Horizon

ASIA PACIFIC

China

Small Covid-19 outbreaks emerged in Jiangsu and Anhui provinces, prompting targeted lockdowns. Anhui reported 292 cases on 2 July, while Wuxi city in Jiangsu, a hub of semiconductor manufacturing, shut down restaurants in response to 42 new cases. Yiwu, a center of consumer goods manufacturing in Zhejiang province, cancelled flights to Beijing after discovering three new cases over the past week.

EUROPE

EU/Russia

This week, the European Commission is expected to reveal its new guidelines on implementing the bloc’s sanctions on Russia concerning the transit of goods to the Kaliningrad region. Unless any changes are introduced, restrictions on new categories of goods for transit are scheduled to come into effect on 10 July. This would further heighten tensions between Brussels and Moscow, with Lithuania as a transit country, being a potential target for Russian provocations. However, significant concessions from the EU amid explicit Russian threats would create a dangerous precedent, which could prompt new threats from Russia aimed at sanctions easing.

Russia

On 5 July, the lower house of parliament adopted in the first reading a package of amendments allowing the authorities to compel any entities operating in Russia – regardless of their legal form or ownership – to support the country’s armed forces during military operations outside Russia. According to an explanatory note accompanying the bill, there is an urgent need for military equipment, repair services, and other technical and material support. The speedy consideration of the bill indicates that it might be adopted before the end of the spring parliamentary session later in July. The move suggests that Moscow is mobilizing the Russian economy and industry to sustain the ongoing war effort over the long run.

LATIN AMERICA

Chile

Following a 12-month drafting process, the new constitution was officially delivered to President Gabriel Boric in a special ceremony yesterday, 4 July. The constituent assembly has now been formally dissolved. A public referendum to ratify or reject the new constitution will take place on 4 September. For the last few weeks, polls have indicated that a majority of voters would reject the new constitution despite a landslide vote in favor of constitutional change in 2020. However, polls also point to a high number of undecided voters. Campaigning is likely to be highly polarizing – when the new constitution was meant to bridge the divides in Chilean society.

MIDDLE EAST AND AFRICA

Ghana

Representatives from the International Monetary Fund (IMF) are reportedly arriving in Ghana, tomorrow, 6 July to commence negotiations with the government about a bailout program. This follows the last-minute U-turn by Ghanaian authorities on seeking support from Fund to deal with deteriorating economic conditions. President Nana Akufo-Addo, on 1 July, directed Finance Minister Ken Ofori-Atta to begin talks with the IMF after demonstrators took to the streets on 28 June to protest what they say is increasing economic hardship in the country.