The prospects for de-escalation are slim in Ukraine. Japan will unveil another stimulus package. In France, all eyes are on the legislative elections. Citizens in China’s capital are anticipating a Shanghai-style lockdown. Ferdinand Marcos Jr. remains the favorite in the Philippines presidential election.

Meanwhile, South Korea’s incoming president is trying to rebuild ties with Tokyo, the center-left has won the Slovenian elections, and the military remains at the center of the debate in Colombia.

Chart of the Week

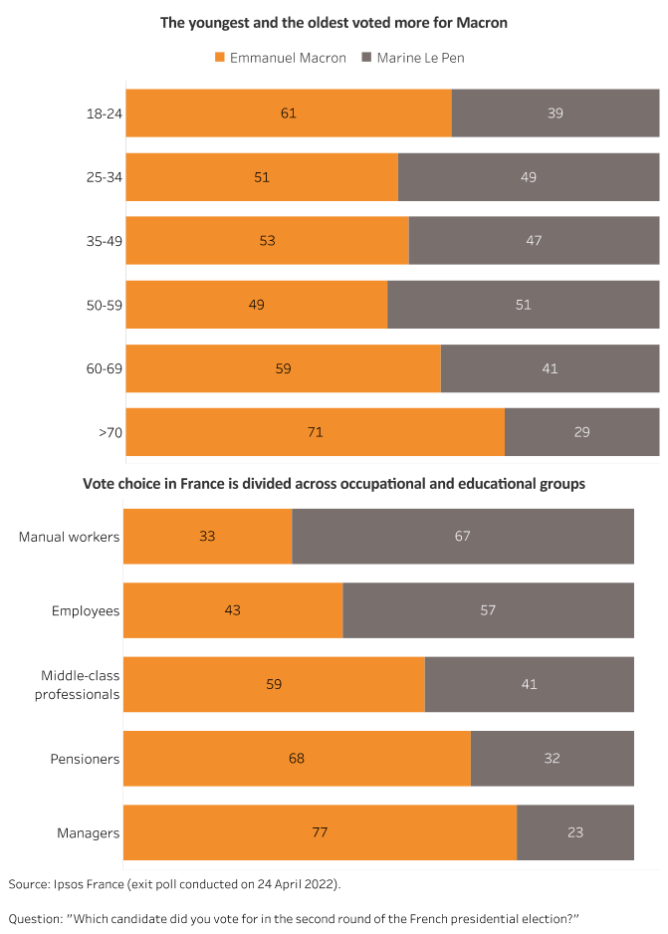

The results of the French presidential election show the deeply-rooted divisions underpinning contemporary politics in rich democracies. Unsurprisingly, the graph above shows that well-off and high educated voters tended to vote for President Emmanuel Macron, while the opposite is true for less skilled workers without university degrees in more deprived areas of the country. At the same, however, age – unlike what is observed in other countries – does not align as clearly with voting patterns as occupation. Interestingly, Macron’s support came most clearly from the youngest and the oldest cohorts, while those in the middle were almost perfectly divided between both candidates. Meanwhile, the strong performance of a new liberal political party in Slovenia might suggest that the liberal camp is also realigning outside Western Europe.

What to Watch

Russia/Ukraine

UN Secretary General Antonio Guterres will head to Moscow on 26 April and to Kyiv on 28 April in an attempt to de-escalate fighting and scale up humanitarian assistance to Ukraine. However, the prospects of success are slim. In the meantime, EU member states are this week set to continue discussions on their new, sixth package of sanctions on Russia, which might include some restrictions on oil imports and expanded financial-sector sanctions. An agreement on an immediate and full-scale oil embargo remains unlikely for now.

Japan

The cabinet is expected to finalize another package of economic stimulus measures on 26 April. It is set to include an extension and increase of gasoline subsidies, direct payments to low-income households, and help for smaller businesses. Meanwhile, the Bank of Japan's Monetary Policy Committee will hold a scheduled meeting on 27-28 April, with a slumping yen putting new pressure on the Bank's long-term policy of monetary easing.

France

Following President Emmanuel Macron’s re-election, all eyes will be on the June legislative elections. Newly elected presidents have tended to benefit from a combination of electoral momentum following their victory and the demobilization of the electorate of opposition parties in the legislative elections. However, Macron is the first president to be re-elected since Jacques Chirac in 2002, which means there is no recent evidence regarding how voters might behave this time.

China

Beijing’s largest district, Chaoyang district, will require all residents to take three Covid-19 tests in the coming week. The city uncovered 22 new cases on 23 April. Beijing residents cleared out supermarket shelves over the weekend as they anticipate a full Shanghai-style lockdown.

Philippines

The last few surveys before the 9 May elections will be released starting this week and they are likely to confirm that Ferdinand Marcos Jr. is the overwhelming favorite to win the presidency. However, a key source of uncertainty is the lack of clarity from Mr. Marcos on who his key economic advisers are likely to be.

On the Horizon

ASIA PACIFIC

South Korea

A team of incoming foreign policy aides is on a five-day visit to Tokyo this week to meet political and business leaders. This is part of efforts by incoming president Yoon Seok-youl to rebuild fractured ties between East Asia's largest democracies. The delegation may meet Japanese prime minister Fumio Kishida on Wednesday.

EUROPE

Slovenia

The center-left newcomer Freedom Movement (GS) claimed a convincing victory in the 24 April general elections. They will likely form a coalition with the Social Democrats (SD) and The Left. The solid electoral performance by the GS will likely facilitate timely government formation and political stability in the longer term. If approved, the new center-left coalition cabinet would focus on strengthening the rule of law, advancing green and innovative policies, and closer ties with Brussels.

Turkey

A draft bill containing new social media regulations, which has been heavily criticised for posing a threat to create a censorship mechanism, is expected to be submitted to parliament shortly. The bill consists of 60 articles, focusing on punishing the spread of “false information” on social media with fines and imprisonment. Just like the recent amendments to the electoral law, the social media bill is another measure aimed at helping the ruling coalition ahead of the 2023 presidential and parliamentary elections.

LATIN AMERICA

Brazil

The issuing of a pardon from a 10-1 sentence ruled by the Supreme Court (STF) against an ally federal representative by President Jair Bolsonaro will continue to dominate politics this week. Daniel Silveira from the rightwing Brazilian Labor Party (PTB) was condemned for threatening the STF and the country’s democratic order. The opposition in Congress attempts to annul the pardon alleging it is unconstitutional based on its partiality (one individual, for political reasons). The House questions whether the STF has the competence to annul a representative’s mandate. Supporters of the president are to organize a protest against the court on 27 April.

Colombia

This week will see the military remain at the center of political debate. Tomorrow, 26 April, Congress holds a vote of censure against Defense Minister Diego Molano following a recent controversial military operation. The vote comes amid a spat between the leftist presidential candidate Gustavo Petro and Army commander General Eduardo Zapateiro after Petro alleged that some generals were in the pay of the Clan del Golfo, Colombia’s leading drug-trafficking organization. Zapateiro’s fierce reaction to the allegation was controversial because the military is barred from engaging in politics. The exchange could increase perceptions that the political establishment is intensifying its campaign against Petro, who continues to lead the polls ahead of the 29 May first-round vote. A CNC poll carried out last week put Petro on 38% and his nearest rival, Federico “Fico” Gutierrez, on 23.8%, with Petro also prevailing over Gutierrez in an eventual run-off vote.