Two Chinese-made Covid-19 vaccines will be scrutinized by the WHO. Italy’s prime minister could resign in the coming days. The popularity of Brazil’s president has declined amid a worsening of the pandemic.

Meanwhile, Japan will pass a supplemental budget, a new coalition government will be formed in Estonia, an Argentinian state-run energy company has proposed a large bond restructuring, and the parliamentary majority backing Ghana’s president has been tested.

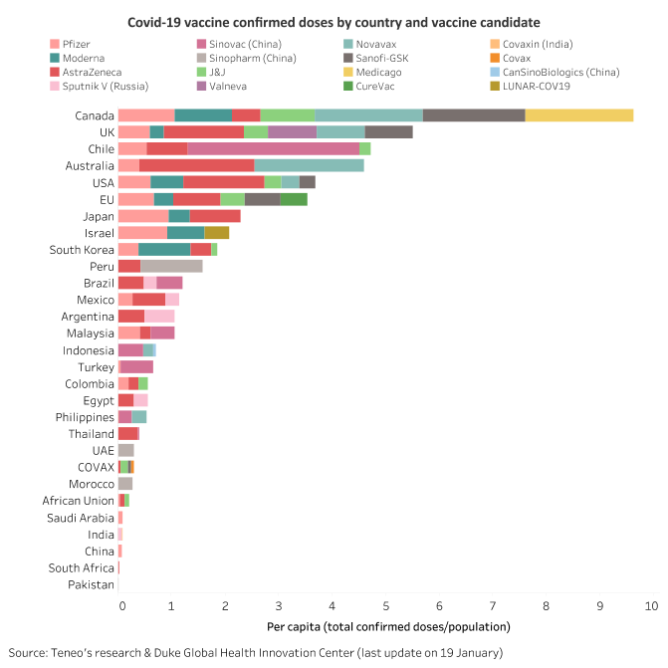

Chart of the Week

Many countries across the globe have secured several bilateral deals with vaccine manufacturers. Among rich democracies, countries have already purchased enough doses to vaccinate their populations several times over. However, vaccine supply appears to be a problem in the immediate term in the EU, where only two vaccines have been approved so far and their manufacturers are delivering the doses less rapidly than expected. Meanwhile, in emerging markets, low and middle-income countries tend to rely on a smaller range of vaccine manufacturers, including Chinese and Russian suppliers, as well as Covax, the WHO's vaccine distribution scheme. The pace of the vaccine rollout in developed markets will also impact access for low and middle-income countries. The slower the progress in developed markets, the longer until greater amounts of vaccines will be passed on to the developing world.

What to Watch

China

The World Health Organization will begin consideration of two emergency approval applications for Chinese-made Covid-19 vaccines this week. Sinopharm and Sinovac have already signed export deals for millions of doses, despite concerns about spotty disclosure of data from clinical trials.

Italy

Prime Minister Giuseppe Conte is likely to resign either before or after a critical vote in the Senate that is currently scheduled on 27 January. Conte’s resignation, marking the formal start of a political crisis, would be handed in with a view of forming a broader based coalition. It is unclear whether Conte’s tactical resignation would pay off and see him returning as the top candidate to lead a new government.

Brazil

This week will see whether President Bolsonaro’s decreasing approval ratings will have an effect on the ongoing race for House Speaker and Senate Chairman in Congress to be decided on 1 February. The mishandling of the Covid-19 pandemic and the tragic increase in deaths in northern states due to the scarcity of oxygen supplies have brought back calls for impeachment. Meanwhile, motorcade rallies took place over the weekend in more than 20 capital cities calling for the ousting of the president. Against this background, the congressional elections on 1 February have become even more important since they may determine the feasibility of an impeachment process. On the judicial front, prosecutors have prepared formal charges against the president for prevarication during the pandemic; however, the country’s public prosecutor, Augusto Aras, an ally of the president, may refuse to forward them to the House for authorization to investigate further.

On the Horizon

ASIA

Japan

The Diet will pass a FY 2020 supplemental budget worth JPY 19tn (USD 183.1bn) sometime this week. Opposition parties have pushed for changes since the budget was drafted before a surge of Covid-19 cases led the government to declare a new state of emergency earlier this month. The Suga administration, however, pressed ahead to ensure that the distribution of relief funds proceeds without interruption. Once the budget passes, the Diet will turn its attention to legislation that will enable authorities to penalize non-compliance with measures linked to emergency declarations and the FY 2021 budget.

India

Protesting farmers are preparing to drive 200,000 tractors into New Delhi on Republic Day on 26 January. They aim to highlight their opposition to three farm laws passed by the federal government. These protests will take place days before parliament convenes for its budget session on 29 January.

Vietnam

The Communist Party will hold its quinquennial congress from 25 January to 2 February to choose the country’s next set of leaders. Communist Party general secretary Nguyen Phu Trong is expected to be granted a third term and the rest of the likely choices for the other top three positions – prime minister, state president and national assembly chair – indicate continuity in leadership and policy.

EUROPE

Estonia

A new coalition government consisting of the liberal Estonian Reform Party (ER) and the Centre Party (EK) will likely be approved by parliament on 26 January. The new cabinet – led by the ER’s leader Kaja Kallas – is expected focus on managing the Covid-19 pandemic and the economic fallout from it. While the outlook for government stability is positive, key signposts to watch include potential tensions around the presidential election in autumn 2021 and the general poll in early 2023 as well ethnic minority issues.

LATIN AMERICA

Argentina

State-run energy company Yacimientos Petroliferos Fiscales (YPF) will be under the spotlight in the coming days following its proposed USD 6.2bn bond restructuring. Not only is there strong resistance to the proposal among bondholders, but the confirmation last week that YPF’s chairman Guillermo Nielsen is leaving the company is the cause of wider consternation. Neilsen is not only a pragmatist, but he also has extensive experience in debt restructurings. His replacement, Pablo Gonzalez, is a close ally of powerful VP Cristina Fernandez (CFK); his appointment therefore marks CFK’s growing political reach and suggests that the priority at YPF over most of this year will be to keep fuel prices as low as possible ahead of the October mid-terms.

MIDDLE EAST AND AFRICA

Ghana

A vote on the new cabinet unveiled on 21 January will put President Nana Akufo-Addo’s shaky parliamentary majority to a new test. Akufo-Addo retained key ministers such as Minister of Finance Ofori-Atta but cut back the number of ministerial positions compared to the previous cabinet. Following the government’s earlier defeat in the election of the parliamentary speaker position, confirmation of Akufo-Addo’s candidates will provide the next test for the government’s slim majority. The sizeable reduction of the new cabinet compared to the previous should be regarded as a first concession to the new reality of a more assertive parliament, while the staggered release of a batch of deputy minister positions may serve to coerce party loyalties.