In China, a Sars-Cov2 vaccine could be ready soon. Brazil’s president seems to be facing increasing contestation from civil society. Russia’s government will ramp up fiscal stimulus. South Africa is moving to pandemic “level 3.” Germany’s government will finalize plans for a stimulus package.

Meanwhile, South Korea is preparing for the largest-ever supplemental budget, negotiations between the UK and the EU are unlikely to progress this week, Mexico is still facing high numbers of new cases and limited testing capacity, and Nigeria’s government is relaxing the country’s lockdown further.

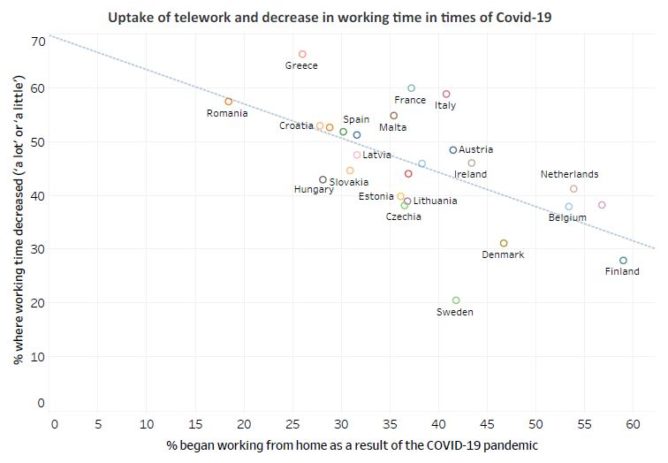

Chart of the Week

Remote working has become increasingly common in the European Union as a result of the pandemic, although important differences exist across countries. In countries where more people are able to work from home, fewer workers reported that their working time decreased. In contrast, levels of non-standard (i.e., temporary and part-time) employment are high in eastern and southern Europe, particularly in low-skill sectors badly hit by the pandemic such as tourism and retail. This explains why a much higher proportion of workers fear losing their jobs in these countries. Therefore, the Covid-19 crisis could reinforce the preexisting inequalities in economic development and labor market outcomes across the EU.

What to Watch

China

Affiliates of state-owned pharmaceutical group Sinopharm could have a Sars-Cov2 vaccine ready by late 2020 or early 2021, according to the cabinet agency that oversees the country’s state-owned enterprises. Vaccines developed by the Wuhan Institute of Biological Products and the Beijing Institute of Biological Products are in phase-two 2 clinical trials and have already been tested on 2,000 people. The latter aims to build production capacity of 100-120mn doses per year. In total China has five vaccines in human trials.

Brazil

Brazil is now only behind the US in number of confirmed COVID-19 cases, and fourth in the world in number of deaths. The week will be a major test for the region of Sao Paulo as it starts a five-phase exit strategy on 1 June. The decision by governor Joao Doria comes one week after he hinted at the possibility of establishing a full lockdown in the region, which was met with strong opposition from research groups at the University of Sao Paulo. Polls show that 76% of the population a in favor of social isolation and that 57% would like it to last until contagion risk is minimal. The week should also serve to gauge the existing support level for new civil-society pro-democracy movements that have emerged recently as a reaction to President Bolsonaro’s continued aggressive narrative against democratic institutions. Polls show that only 25% of Brazilians support Bolsonaro’s government, while 50% oppose it.

Russia

On 1 June the government is expected to present a national economic recovery plan for the period until 2021. This is intended to boost the country's so far relatively modest fiscal response to the Covid-19 crisis. The total worth of the draft plan is estimated around RUB 8trn (USD 114bn), although this may include the previously announced measures worth around RUB 3.3trn (USD 47bn). The recovery plan will still be reviewed by the Kremlin before its final roll out. In addition, this week President Vladimir Putin may announce a new date for the postponed vote on the constitutional amendments allowing him to run for two more six-year terms as president.

South Africa

From 1 June, South Africa moves to “Level 3” of its “risk-adjusted” pandemic framework. This will allow most economic sectors to restart (with notable exceptions including the tourism industry). However, the faster reopening comes as Covid-19 infections are projected to increase and many aspects of South Africa’s exit strategy remain contested, including a poorly prepared reopening of schools and places of worship. With the ANC mooting a ZAR 350bn infrastructure fund to boost South Africa’s recovery prospects, market attention will likely focus on a party proposal to amend the Pension Fund Act and for the Reserve Bank to create a ZAR 500bn “funding instrument with development finance institutions” to support infrastructure investment.

Germany

Government coalition partners will meet on 2 June to finalize their plans for an economic stimulus package. nGiven the degree of political contestation around the design of the package, the meeting could drag on well into the early hours of the following morning. A package of up to EUR 150bn is expected, offering support to various groups from small businesses to families with children. One factor to watch is the Social Democrats’ plan for a “rescue fund” for over-indebted municipalities. If meaningful progress is achieved on this, it could be positive for the public investment outlook – as well as for the domestic political sustainability of German support for a bold rescue fund in Europe.

On the Horizon

ASIA

South Korea

Moon Jae-in’s administration will submit Korea’s largest-ever supplemental budget to the National Assembly on Thursday, 4 June. The total could be as much as KRW 35tn (USD 28.5bn), more than the two previous supplemental budgets introduced to combat the effects of the pandemic. While the bulk of the budget will go towards emergency fiscal outlays, a sizable portion of the budget will be directed towards Moon’s plan for a “Korean New Deal,” an ambitious plan to develop new engines of growth through digitalization and the transition from carbon emissions.

EUROPE

Italy

Unrestricted travel between regions will resume from 3 June, including Lombardy that remains by far the hardest-hit region in the country. The uniform reopening across the whole country has caused division among the regional governors, with some now considering bringing in their own local restrictions on people arriving from other regions. On 3 June the country will also reopen to EU travellers and scrap a 14-day mandatory quarantine period.

UK/EU

Negotiation teams will this week convene for one final round of talks before the highly anticipated leaders’ meeting later in June. However, the slow progress so far renders a breakthrough unlikely. All eyes will then turn to PM Boris Johnson’s meeting with the heads of the EU institutions, expected after the 18-19 June European Council. A possible compromise in domestic UK politics could entail no extension request for the transition, but enough movement to achieve a basic free trade agreement by year-end. A short period for phasing in the new border checks (a transition extension in all but name) could then still be agreed for the first months of 2021.

LATIN AMERICA

Mexico

The relaxing of lockdown that startson 1 Juneis controversial given that a) the number of daily new cases remains high (over 3,000 new Covid-19 cases were reported yesterday), b) testing levels remain very low, andthat c) almost the entire country remains at “red” under the government’s traffic light system. The resumption of President Andres Manuel Lopez Obrador (AMLO)’s domestic tours will likely arouse further political acrimony. AMLO will be in Quintana Roo state today to inspect how construction of the 1,525km Mayan Train (Tren Maya) is progressing. Opposition parties say that AMLO’s tours undermine official shelter-at-home guidance and will do little to resolve problems faced by the overrun health system or by ordinary people facing economic hardship.

MIDDLE EAST AND AFRICA

Nigeria

The government is expected to relax Covid-19 containment measures further on 1 June. Even though the number of daily confirmed new cases shows no signs of abating, the government is likely to give in to public pressure and allow states to decide on the reopening of schools, businesses and worship centers shut since March. Additionally, the government is expected to provide a timeframe for the lifting of the nationwide overnight curfew, the ban on interstate movements as well as the lock-down of Kano state.