Part 1: Can Consumer Products Suppliers Navigate the Disruption?

Consumer Products Suppliers Under Threat

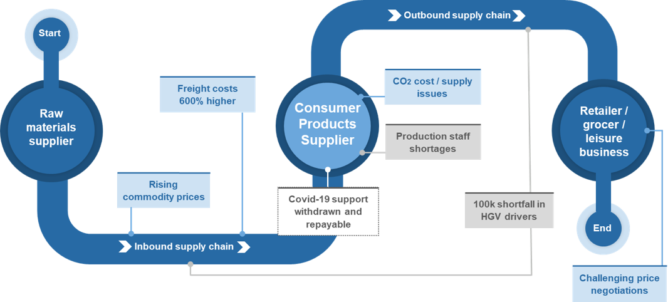

As world economies have started to reopen a number of issues have emerged in the Consumer Products supply sector which are causing significant challenges to businesses.

Labour and haulier shortages are creating high profile operational disruption. Companies that have reported stock shortages in recent weeks include JD Wetherspoon (beer), McDonalds (milkshakes and bottled drinks), Ikea (bedding ranges), and Nando’s (chicken).

Lost sales for Consumer Products suppliers as a result of disruption directly impacts profitability and, in many cases, the availability of funding via invoice discounting facilities – with the added issue of stock wastage for suppliers of perishable goods.

Suppliers also face a rising cost base that may be challenging to pass onto grocers, retailers and leisure businesses. This squeeze on margin and cash is also coming at a time when UK Government support for Covid-19 related issues is either being withdrawn or is being repaid.

UK manufacturers are arguably the worst hit with the combined impact of disruption to raw material supply, production staff shortages and distribution difficulties creating slower throughput and manufacturing inefficiencies.

Longer term, businesses will likely need to reassess the efficacy and resilience of existing supply chains and lean operating models and consider how they might redesign them to provide greater security of supply and address an expected increase in focus on sustainability and environmental concerns.

The challenge for businesses is considerable and will take time to resolve.

Labour and Haulier Shortages

Sales by Consumer Products suppliers into retailers, grocers, leisure businesses and other industries are being severely hampered by two factors:

- A shortage of heavy goods vehicle (“HGV”) drivers to transport inbound raw materials to Consumer Products suppliers and transport outbound finished goods to retail, grocer and leisure customers; and

- Issues properly staffing production and processing facilities.

Hauliers

The Road Haulage Association estimates a shortage of 100k hauliers, stating “critical supply chains are failing due to a significant shortage of HGV drivers”. This is driven by various factors, including:

- Foreign drivers who returned to their home countries due to Covid-19 or Brexit;

- Fewer HGV driver tests due to Covid-19 restrictions;

- A lack of younger drivers to replace retirees (average age of an HGV driver is 55); and

- The withdrawal of agency labour as a result of changes to IR35 tax regulations.

Some Consumer Products suppliers are being forced to consider alternative distribution strategies, with British Sugar recently reporting that it will use its own tractors to deliver sugar beet to their factories. But not all businesses will have alternatives.

Whilst initiatives are in place to incentivise new and returning drivers, these actions are unlikely to deliver results in the near term and in late September the Government provided a temporary relaxation on working permits to attempt to fill the gap.

Labour Shortages

Labour shortages are impacting other parts of the supply chain, particularly food production, with staff shortages for fruit pickers and in abattoirs among recent headlines. Farmers and growers may be left with produce and livestock that processors do not have capacity to handle, leading to wastage and lost profits.

The impact of enforced isolation (the “ping-demic”) during the UK summer months is still being felt. Whilst isolation regulations have since been relaxed, rising case numbers during the winter months may further hinder efforts to clear backlogs of production and orders.

Knock-On Impact on Manufacturing

These shortages result in supply chain delays and process, production and manufacturing inefficiencies.

Delays to inbound deliveries of raw materials or component parts disrupts processing and production schedules planned largely on a just in time basis and may need rephasing at short notice.

This, combined with staff shortages, can result in machine downtime, operating inefficiency, lower sales given reduced production of finished goods and higher costs. There is then the added issue of a shortage of lorry drivers for outbound transport to Consumer Products customers, further slowing manufacturing throughput.

CO2 Crisis – Food Industry Specific

Due to increased demand as economies reopen post Covid-19, as well as a cold winter in 2020/21, wholesale natural gas prices have risen by 250% since January 2021. This has placed significant pressure on UK fertiliser plants that use high quantities of natural gas, leading to reduced production or plant closures.

These fertiliser plants produce CO2, which is used across the food industry from stunning pigs and poultry, to food packaging, cold storage transport and in fizzy drinks. Therefore a regular supply of CO2 is critical.

In September 2021, the UK Government stepped in with a support package for one closed plant, seeking to avoid supply chain disruption, with the ultimate answer being that CO2 prices needed to rise to ensure that its production is viable. However, the UK Government also intimated that this was a once in a lifetime deal and that CO2 alternatives are needed. Ongoing supply chain disruption is still a risk.

Rising Costs / Inflation

1. Input Price Prices

Commodities: The Food and Agricultural Organization that tracks international food prices stated in May 2021 that prices were at a 10-year high and had consistently risen during the Covid-19 pandemic. This is mainly driven by harvests suffering, rising demand in the Far East for certain meats and oil prices being at a three year high.

CO2: The CO2 crisis is likely to result in significant price rises. George Eustice stated that the food industry would have to accept a “big, sharp rise”. Some commentators are expecting a five-fold increase in price.

Packaging: The spike in demand for e-commerce and home deliveries has driven a surge in packaging costs.

2. Freight Costs

Asia-Europe freight costs have increased substantially in the last year with the XSI showing a 600% increase since September 2020. Restrictions and closures at ports have combined with a sharp increase in global demand for containers (up 20% in two years according to the WTO) to drive a substantial excess in demand. Many Consumer Products suppliers are reliant on international shipping of raw materials or components to the UK and there are few viable transport alternatives.

Trade through Britain-NI-ROI trade has been disrupted by border checks and paperwork since Brexit in Jan-21, with freight becoming congested and more expensive as a result.

3. Wages

Staff costs have also been rising, with increased wages and bonuses paid to retain and recruit staff where they are scarce, as well as annual increases in the National Living Wage and the new employer contributions to health and social care tax.

Retention of critical employees is likely to come at a cash cost and remain for the foreseeable future given immigration and working visa changes post Brexit.

Consumer Products suppliers will likely seek to pass these higher costs onto their retail, grocer and leisure customers. However, this will not be possible for all companies given the competitive and price sensitive nature of customers’ markets and where bargaining power is low.

Lower margins due to rising costs and disrupted supply chains impact profitability and cash. At a time when government Covid-19 support is being withdrawn this pressure could manifest itself as anything from covenant issues to refinancing challenges or funding requirements.

Building Supply Chain Resilience

"Just in Time" Vs "Just in Case"

Recent supply chain disruption has exposed the risk of keeping inventories to a minimum. Longer-term, we may see a shift from “just in time” to “just in case” stock order models as companies seek protection from future shocks. For instance, Toyota largely mitigated the impact of a global shortage of semi-conductor chips by stockpiling several months’ supply, enabling ongoing production while other car manufacturers suspended their own.

Such an approach would improve a company’s supply chain resilience, however at the expense of increase storage costs and working capital requirements.

Assessing Vulnerable Suppliers

Companies will also need to critically assess which of their suppliers are most vulnerable to shortages and whether the price benefits of relying on a small pool of suppliers outweigh the potential costs of disruption.

The importance to Consumer Products suppliers of knowing and monitoring their supply chain, understanding what critical goods and services it relies on and preparing for unforeseen disruptions has been made very apparent. Yet identifying financial distress is challenging as financial data is not typically in the public domain. However, during Covid-19, customers and key suppliers exchanged more management accounting information than ever before to strengthen relationships and support one another. Time will tell if this results in a permanent shift to an open book system where agreements may even include operating covenants to monitor performance.

Use of Data Analytics

Another key trend is a growing investment in sophisticated data analytics tools to monitor supply chain risk.

However, whilst these tools may provide early insights into general market and geo political threats and / or operational performance flags, monitoring the financial health of a key trading partner still relies on old fashioned relationships and, importantly, having access to some form of regular management accounts.

Rising Importance of the ESG Agenda

The importance of the ESG agenda could be a further driver of supply chain innovation, in particular reducing carbon footprints by simplifying and reducing supply chains.

On-shoring or near-shoring supply chains may be part of carbon footprint reduction, as well as being effective in mitigating against further geographical disruption. This would also require changes to all the practices that go with supply chains, for example logistics considerations, procurement and finance.

This All Requires Investment…

Such transformational change in supply chains requires investment. Larger, better capitalised Consumer Products suppliers that have greater economies of scale could be better placed to make these changes and make them permanent.

Due to investment or other constraints, other businesses may only be able to make temporary changes to survive the current situation and will then revert back to a pre-pandemic “just in time” model.

Supply Chain Crisis – Consumer Products Suppliers

Consumer Products suppliers that have been negatively impacted by Covid-19 are likely to find it challenging to absorb such drastic operational disruption and a number of cost increases. Many of these issues are outside of suppliers’ control, yet can be significantly damaging.

The impact of these sector challenges will be most keenly felt by mid-market companies that are exposed to Christmas seasonality and who lack the purchasing power and financial reserves of larger firms to secure access to hauliers, staff and raw materials, as well as the leverage to pass on rising costs to customers.

In the coming weeks and months, we expect that a number of businesses will face significant challenges in this sector and believe there are two key factors that Consumer Products suppliers need to consider: careful cash planning and balance sheet optimisation.

Cash: Planning Ahead

The peak Christmas trading period is a major risk if supply chain issues translate to empty shelves or restricted availability.

The cash impact of supply shortages and resultant lost sales could potentially provide a funding hit now. In addition, a lack of profit generation over Christmas 2021 could also manifest in cash issues in Q1 of 2022, when funding availability in asset based lending facilities typically reduces, but payments are due to suppliers for Christmas stock.

Key C-suite Questions

Do you have a rolling 13 week and medium term cash flow forecast? Have you modelled downside scenarios? Have you forecast financial covenants? Do you understand your bargaining position with customers, suppliers and hauliers? Are there cost reduction measures that could offset price rises? Are there alternate haulage and staffing options? Are lenders and shareholders being supportive? Are there any additional sources of funding?

Balance Sheet: Optimisation

Inventory and working capital management will be key to the cash preservation needed to navigate through the next few months. The cash impacts of disrupted supply chains and squeezed margins may also be exacerbated by the withdrawal of government Covid-19 support. Businesses need to factor in the unwind of balance sheet support as part of cash forecasting to consider its impact on debt servicing requirements.

Key C-suite Questions

Can you reduce customer payment terms, or use supplier finance platforms to speed up receipts? What is the optimal level of stock holding, bearing in mind it ties up cash, but contingency stock is needed for supply chain delays? What level of goodwill do you have with suppliers to agree to extended payment terms? Are you aware of your suppliers financial position to understand their risk of failure and impact on your business? Is there any scope to extend payment terms of key liabilities, for example a time to pay arrangement with HMRC? Can you amend or extend debt repayment terms?

Supply Chain: Time to Change?

The current challenges are forcing Boards to critically assess the robustness of their supply chains.

If areas of fundamental change are identified, then the process of designing and implementing the solution can be complex and take time to achieve. Transformation processes will require investment and possibly a cultural shift to be successful.

Key C-suite Questions:

Is a “just in time” model still appropriate? Does a global supply chain leave you exposed? Are there opportunities for vertical integration? Are there near-shoring or re-shoring options? Can geographical and supplier diversification be achieved? Is there a way to change product offerings to spread demand over the year and reduce seasonal risk? How does my supply chain need to change to align with the ESG agenda? What investment is needed? What level of investment is needed to achieve these goals and what sources of investment do you have?