We are in the midst of two concurrent and unprecedented business events. The current economic cycle is the longest in U.S. history, at over ten years, and we are enjoying the longest bull market in history that has seen the S&P 500 rise from 676 in March of 2009 to a recent high in July 2019 of 3025. However, economic cycles do not go on forever, and we are approaching an inflection point; the question is not whether there will be a downturn, but when.

It is no secret that economic downturns are usually accompanied by declines and pronounced volatility in the financial markets. This time, we approach the inflection point of the economy with a stock market at near-record levels, well above its long-term trendline, and sporting valuations seen on only a few occasions, all of which are potentially destabilizing to equity values. The reversion to more typical valuations could be magnified by record corporate and public debt levels, structural changes in how investments are managed, plus the large number of investors and executives who have never experienced hostile market and operating conditions.

This paper presents the current environment in a long-term context, provides a preview of what to expect when the cycle turns, and provides high-level recommendations on how to contend with the changed business and financial environment that will result.

The key is to begin now, while business conditions are reasonably solid and financial markets remain favorable, to develop mitigation strategies for the inevitable next downturn to help bolster a firm’s reputation and ease the downward pressure on valuation and market capitalization.

The Debt Overhang

Business conditions are, at the moment, fairly robust, but there are incipient signs of weakening fundamentals.

- Global Manufacturing PMIs, including the headline ISM Manufacturing, have turned down below levels that indicate economic contraction.

- Wall Street banks are cutting their 2020 GDP forecasts.

- Demand for freight transportation is weakening across many transport modes, both domestically and non-U.S.

- Yield curves across multiple durations have inverted, which typically signal weak economic conditions, albeit with some time lag.

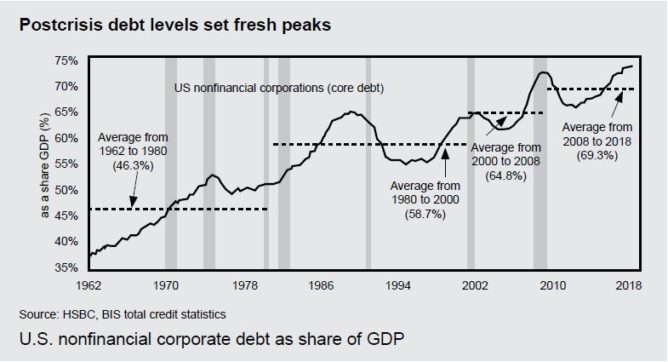

Despite being in the late stages of the cycle, U.S. corporations are financially over-extended, carrying record levels of debt.

In addition to the amount of corporate debt, the quality of the overall bond market has eroded significantly, becoming skewed toward the lower end of the quality spectrum. The lowest rated tier of the investment grade bond market, BBB, now exceeds 50% of the IG index, and investor protections on recent bond issues are weak. A slowdown in the economy would most likely pressure business profits and challenge the creditworthiness of those companies with high leverage, leading to downgrades and possible defaults.

The amount of BBB-rated debt is more than twice the size of the high-yield bond market. There might not be enough capital in the HY market to absorb meaningful amounts of downgraded BBB debt as it is sold off by funds that are required to hold IG credits.

The high leverage in the corporate sector is not lost on investors. Concern today about leverage exceeds that that at the top of the Global Credit Crisis in 2008/2009, according to a recent BofA Merrill Lynch Global Fund Manager Survey.

With the S&P 500 currently near an all-time high, it is well above the long-term trend line and it carries a valuation exceeded only during the “dot.com” frenzy. Investors remain complacent about the risks, as evidenced by the VIX being only slightly above the all-time low.

Valuations do not necessarily cause bear markets; recessions and earnings shortfalls do. But valuation determines how bad the fall is going to be. The higher the valuation, the wider the gap is to revert back to normal. And when markets turn, they tend to frequently overshoot their long-term fair values, so an overextended market simply has farther to fall.

In addition, when investor sentiment turns negative, market volatility could be exacerbated by structural changes in the financial community. During the past decade, trillions of dollars of investable funds have shifted from active to passive managers, such as index funds and exchange-traded funds (ETFs), who have become large holders of large capitalization companies. Further, the unprecedented duration of the current market cycle means that there are many people in the financial industry who have never experienced a recession or bear market.

Impact of New Investing Paradigms

Reflecting the shift toward passive investment management, the five largest index funds and ETF managers (The Vanguard Group, BlackRock, State Street Corporation, Fidelity Investments and Charles Schwab) have almost doubled their market share, and now own almost half of investable assets. These low-turnover funds arguably reduce the realistic float and trading volumes of the companies they own.

In addition, quantitative investment strategies, in which investment decisions are made through computerized algorithmic trading, have doubled their share of trading volumes. Their trading has overtaken actively-managed hedge funds and traditional asset managers, whose share of trading has declined in the past five years.

Given how large they have become relative to the market, we do not know how these passive and algorithmic funds will perform in a risk-off market. There could very well be mismatches in liquidity between the index funds and ETFs - which must quickly provide proceeds to holders who redeem - and the underlying holdings. Hundreds of billions of dollars are invested in Russell 2000 index funds, but over half the stocks (1,049) trade less than $5 million a day and almost one-quarter (456) trade less than $1 million a day. Once psychology turns and investors want to get out of the market, the compound effect of one-sided trading and reduced float may cause an automatic sell-off.

Competing for Capital in a Recession and Bear Market

“Everyone has a plan until they get punched in the mouth.” – Mike Tyson

The financial press tends to characterize a bear market in quantitative terms, such as a 20% decline from a recent market top. In reality, bear markets are protracted declines of more than 50% over a period averaging 1.4 years – a psychologically debilitating period when shares decline day after day and virtually every investment decision is a wrong one. That mental aspect has knock-on effects that influence business strategy and decisions, capital allocation, governmental policy, consumer spending, and virtually all aspects

of economic life.

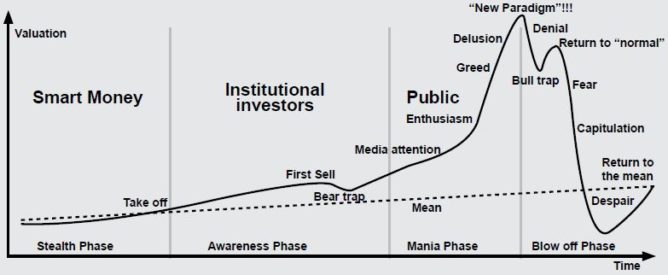

The psychological progression will go through several stages toward despair. Then, when all seems lost, the upturn will commence, as shown in the following chart:

The broad rout can mask companies, some of which are prominent and respected, and industries that are at the cusp of a secular decline and which will never fully recover. For example, the tech and telecom crash of 2000/2001 marked mainstream adoption of web-based computing that left behind many of the “darlings” of the time. It will only be evident after value has been broadly destroyed which companies and industries have been irreparably changed. Management must help investors to understand why their businesses will survive and thrive in the inevitable recovery.

Prepare the Business

During recessions and bear markets, companies face the challenge of making a compelling investment case for a business under pressure and to an audience that is more inclined to sell than buy. Since virtually all stocks will decline, mitigating the damage means competing for and capturing more investment dollars from a shrinking pool.

This requires a strong narrative, supported by a durable business that has been prepared for a hostile environment. Investors will need to hear how the business has been weatherproofed, but for the discussion to sound credible, management must be able to articulate how it has thought about vulnerabilities and what steps it has taken to address them. That means the thinking must have already been done. It is difficult, if not impossible, to make a convincing investment case while scrambling to play catch-up with a rapidly changing business environment.

During a recession and bear market, access to capital will not be a given. Managers must evaluate their capital position and funding needs ahead of the top and use today’s buoyant markets to build a financial position that can weather the storm, with ample liquidity and no material need to raise capital. The BofA Merrill Lynch survey shows that investors are already concerned about the level of corporate debt.

A recessionary environment will obviously put pressure on revenue and pricing to the detriment of margins and profits. Managers should preemptively identify the levers they can flex in the expense base to preserve margins and earnings power in the event of a slowdown, rather than wait for profit pressures.

Even today, investors are starting to assess the ability of companies to preserve earnings power in a hostile business climate, so there is an urgency to this preparation.

Companies are presently repurchasing their shares at record rates despite the maturity of the market cycle and extended valuations. Many of these shares will decline in price, some significantly, during the bear market. Management should prepare a defensible framework for how they determine value and make repurchase decisions that can be used to respond to challenges if share prices decline substantially. Executives are not stock-pickers, but having a methodology in advance can deflect accusations of arbitrariness and ulterior motives.

The current boom in mergers and acquisitions and the shift in business models toward intellectual property have generated a record amount of goodwill and intangibles on corporate balance sheets. In a recession, the performance of acquired businesses could fail to meet expected returns projected and the value of brands, trademarks, IP and other intangibles could come into question. This risks triggering potential impairments which could trip coverage ratios and bank covenants, and in turn cause credit rating downgrades. Managers should stress test, in advance, which intangible assets might be impaired in a more hostile business climate.

Building the Narrative

Because the macro environment will be evolving quickly and lacking in visibility, investors will be inordinately dependent on management’s narrative and commentary on business conditions and prospects to help determine their decisions and portfolio allocations. Maintaining credibility is paramount. The economic headwinds will provide cover for subpar results, so investors will expect management to speak transparently and candidly about the environment, challenges, remedial actions and, of course, successes.

Astute management teams will get credit for foreseeing the downturn and preparing the business for tough times, so it is key to include that thought process in the narrative. While every cycle plays out differently, consider relating how the current environment compares to the Great Recession as a reference, what lessons were learned from that experience, and how they might be relevant here. Share with investors observations on how management prepared the company to outperform its peers in the last recession, how it can manage the balance of fixed versus variable expenses and, to the extent possible, why the business is fundamentally better positioned to survive the downturn.

Since investors will want to put a floor on how low performance can go and for how long, executives should parse the factors affecting the business into those that are cyclical, and will eventually self-correct, versus any that are secular or systemic. Also underscore parts of the business that are less economically sensitive or are of an annuity-type nature, such as subscription services, the earnings power of which should be more stable through the downturn.

In a downturn, the interplay between the income statement and balance sheet becomes crucial, as lower earnings and cash flows can affect liquidity to run the business, coverage ratios, covenants, debt maturities, capital requirements, etc. So, stewardship and preservation of capital will also be at the fore for investors. Management should articulate how the cash flow cycle is affected by the environment and how priorities for capital deployment have changed between maintenance of the business and investing for the future.

Because of the elevated risk related to expected returns on investment in growth during a recession, there will be acute scrutiny of discretionary capital expenditures, especially as they encroach on investor-friendly alternatives, such as return of capital to shareholders. Management must be able to defend discretionary investments and demonstrate that their returns will exceed the cost of capital by a meaningful margin.

Credibility for prudent capital allocation in the past will greatly strengthen management’s license to retain excess capital to invest in the business. Absent that license, investors are likely to demand that capital be returned to them. This topic should be discussed within the context of how much liquidity the company needs to retain to ensure a strong financial position, preserve its competitive advantage, make opportunistic acquisitions and repurchase shares at depressed prices. Given the concerns regarding corporate leverage expressed in the BofA Merrill Lynch survey, this message should be well-received by investors.

Weak economies put pressure on almost all businesses, but the best positioned ones can exploit the challenges faced by their competitors to enhance their market position and start the next cycle in a better place. Thus, a company’s narrative should underscore its competitive advantages (market position, cost advantages, scale, technology, geographical reach, innovation, culture, etc.), describe how they are helping to mitigate cyclical pressures, and articulate how it will use them to win. If investors see a company poised to outperform in the next economic cycle, they will be more likely to hold shares.

Of course, all of this will ring hollow if management has not done the analysis and advanced planning described above.

Review and, as Necessary, Strengthen Corporate Governance

Boards will also come under greater scrutiny — and will be held more accountable — for weak operating or financial performance, faulty strategy and execution, poor shareholder returns and their oversight of culture and governance. Boards should self-analyze to ensure that they can withstand scrutiny of tenure, age, skills, diversity and oversight of the business, and articulate a plan for board succession and refreshment. This is especially true for companies that are undergoing a transformation, as the skills and makeup of the board must reflect where the company is going, not where it has been.

The increasing presence of passive and ESG investment managers, who scrutinize corporate governance and ESG policies and disclosure more aggressively than most investors, means that proxies and annual meetings will receive greater attention and these managers will use the proxy forum as a springboard for their agendas. Consequently, the proxy is a good forum for discussing the company’s philosophy on corporate governance and responsibility to the communities in which it operates. As a matter of course, proxy disclosure must be clear and combined with robust engagement with large shareholders. Goodwill earned when everything is fine will be helpful when shareholder proposals or compensation issues surface where management needs shareholder support.

Credible independent board members can be very effective in discussions with shareholders and proxy advisers. Their involvement signifies that the company understands investor concerns, takes them seriously and is willing to be held accountable.

Proxy advisers must be monitored to ensure they understand what is driving the company’s performance. Proxy analysts are not industry experts, so companies should be prepared to educate them on industrial idiosyncrasies that would not be appreciated from outside.

In addition, in August 2019 the SEC provided guidance that prompts proxy advisers to be more transparent in their methods and recommendations, and holds the veracity of their statements to a higher bar. This could enhance the willingness of proxy advisers to engage with companies to ensure accuracy of their analyses and recommendations. It could also signal that proxy advisors may enhance some of the processes to allow more company feedback, as a result of, or in anticipation of, additional SEC guidance on their reports and recommendations.

In addition, management cannot afford to ignore the retail shareholder base. In a closely contested election or proxy vote, all shareholders count. Companies can engage with and communicate to individual shareholders online and in other ways, especially if a significant proportion of holders are employees or retirees for whom the company has contact information.

Executive compensation could become a lightning rod for investors in general, who will be angered when management teams take home large pay while they are suffering due to poor performance. At the time of this writing the S&P 500 has recently made an all-time high, yet there is already ire building against certain companies whose CEOs were richly compensated while their investors lost money over the past year.

Compensation plans must be developed with a sense of fair play so that all parties share in both the upside and downside. In a bear market in particular, compensation policies that are not aligned with the creation of shareholder value, or are easily manipulated (i.e., non-GAAP metrics that ignore management mistakes, such as write-downs), could come under fire. Compensation committees should consider exercising negative discretion to align compensation with performance, but even that will not excuse a poorly designed compensation program.

Review the Guidance and Outlook Template

The volatile macro environment will make internal budgeting and forecasting more difficult, undermining management’s ability to set appropriate expectations for investors.

Recessions and bear markets provide a license to change how a company sets future expectations for the Street. Review the company’s guidance template to determine if it accommodates a higher degree of uncertainty; the level of precision assumed in a stable environment may no longer be suitable. If not, use this opportunity to reconsider guidance elements for which there is reduced or limited visibility due to market conditions. For example, substitute ranges for single-point forecasts to signal a wider band of potential outcomes. In a rapidly evolving environment, one might provide more detail around the assumptions behind the guidance, to allow external parties to understand how the outlook was derived and to monitor macro developments between reporting periods.

Guidance should obviously be conservative and take into consideration trending, not current, market conditions. One large downward revision in guidance to a level that the company can meet or beat (i.e., the “kitchen sink” approach) might generate a harsh market reaction in the short run. But this is eminently preferable to a series of smaller revisions over time (“death by a thousand cuts”) that will try investors’ patience and make management appear out of touch with the reality of the business and prevailing market conditions.

In extenuating circumstances, where there is little or no visibility into future performance, management may consider dropping guidance entirely. This should be done as a last resort, but if market conditions preclude reliable forecasting, it is better to pull guidance than to continually miss company-provided outlooks.

Continue to Engage with the Financial Community

There is a tendency of executives to hunker down during bear markets and pull in engagement with shareholders and the investment community, as it may feel futile to try to change sentiment and get investors to commit. Or they may believe that their time should be completely dedicated to operations and

trying to “right the ship.”

But it is the job of investors to invest, and they are constantly in search of the best opportunities. For this reason, there is a market for almost any company’s shares. In our view shares are more often “sold” than “bought” and, given the inherent slack demand for shares overall in a down market, it is up to managers to drive demand for the shares by proactively targeting and engaging with potential investors and delivering a compelling investment proposition.

It is also important to eliminate any information gaps that would worry investors. As the market abhors a vacuum, any such void will be filled by covering analysts, the financial media and others, who are often ill-informed or may have their own agenda. It is sub-optimal to have the company narrative co-opted by an outside party, which is why it is so important to maintain the calendar of non-deal roadshows and conference attendance.

Because hostile markets shorten investment horizons, investors’ portfolio turnover will increase and lead to turnover of the shareholder base. Regularly review who has bought and sold shares and consider engaging a surveillance firm to monitor changes in holdings between Form 13-F filings. Analyze the type of investor (active versus passive, hedge fund versus long-only, etc.) and their activities to detect possible future buying opportunities and selling pressure.

Prepare for Investor Activism

Activists, like all investors, will be suffering from performance issues. They will need to generate returns and protect their brand by demonstrating to their investors that they still have influence. And, because activists tend to manage more concentrated portfolios, they face additional pressure to make each campaign successful.

They will be hard to detect if they intend to commence an action against a company, as their success often depends on stealthily taking a stake. But activists will often take an initial position while they get to know a company and are building a thesis, so the shareholder analyses, as mentioned above, can act as an early-warning system.

Companies should preemptively implement a strategy that can be quickly mobilized to defend against an activist approach. At a high level, this entails creating a team of management, legal and financial advisors; performing a candid analysis of the company’s potential vulnerabilities; scenario planning for how the attack might come; development of rebuttals to the likely lines of attack; and identification of third parties and other influencers who can support the company’s campaign if needed.

Companies that are prepared will meet regularly with their advisors to discuss progress of and concerns about the business. They will also have an “evergreen” playbook that can be deployed at the first sign of activist interest.

Final Thoughts

While there might be no immediate threat of a recession or crack in the equity market, we are living on borrowed time due to the record duration of the current economic cycle and stock market run. And because of the elevated level of corporate indebtedness, high equity valuations, investor complacency and increased proportion of formulaically-managed assets, instability could come quickly and violently.

When the cycle does turn, management teams must have prepared their firms to withstand the hostile economic environment and higher scrutiny of their strategies, execution, and capital stewardship.

Because of the long lead times required for that level of preparedness, we recommend that executives use the current favorable economic and market climate to develop and stress-test plans for managing through a much less favorable environment. This will enable them to position their companies to not just survive the downturn but thrive when the next cycle begins.

For this reason, preparation should happen before the storm clouds gather. It’s never too early to start.