In a stated desire to standardize company ESG disclosures and provide investors with comparable information, the U.S. Securities & Exchange Commission (“SEC”) has proposed its climate-related disclosure rule for U.S. publicly-traded companies and certain foreign issuers.

A brief summary of the proposed rule is provided below. We have also analyzed how some of the SEC’s proposed disclosure requirements compare to the two other major global initiatives that are also seeking to standardize company environmental, social and governance (“ESG”) disclosures – the International Sustainability Standards Board (“ISSB”) and the European Union’s Corporate Sustainability Reporting Directive (“CSRD”). While the SEC’s decision to utilize existing climate disclosure standards may be welcomed by some companies, companies will still be faced with many questions as to how to respond to the SEC’s proposed rule in the context of the other two global initiatives. We contemplate some of those questions and offer some practical suggestions for your consideration below.

A Summary of the SEC's Proposed Rule on Climate-Related Disclosures

Qualitative disclosure requirements would include a description of:

(i) board and management team oversight of a company’s climate-related risks;

(ii) how climate-related risks and events may impact a company’s strategy, business model and financial statements;

(iii) any processes to identify and manage climate-related risks; and (iv) any climate transition plan and scenario analysis.

Quantitative disclosure requirements would include:

(i) annual and historical Scopes 1 and 2 GHG emissions data individually and cumulatively, expressed in both absolute terms and intensity;

(ii) annual and historical Scope 3 GHG emissions data if it is deemed “material” by the company or if the company has previously disclosed Scope 3 GHG reduction targets or goals;

(iii) any climate-related targets, goals, activities, use of offsets – if the company has already disclosed such information; and

(iv) the internal price of carbon and process for determining it, if any.

External attestation requirements would include:

(i) obtaining “limited” external assurance for Scopes 1 and 2 GHG emissions data for fiscal year 2024; and

(ii) obtaining “reasonable” assurance of such data for fiscal year 2026 and beyond.

(iii) External assurance for Scope 3 GHG emissions would not be required, and a legal safe harbor for liability of Scope 3 emissions data would be provided.

Are the Same ESG Disclosure Frameworks Being Utilized Within Disclosure Requirements?

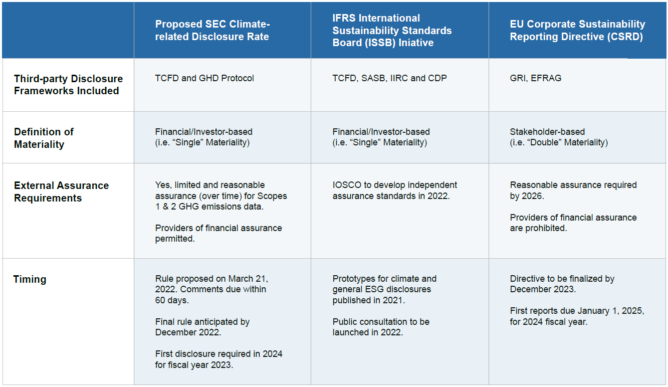

The SEC stated that its proposed rule incorporated the principles of the Task Force on Climate-related Financial Disclosures (TCFD), as does the ISSB (as discussed in our recent piece). However, the SEC did not incorporate elements of climate disclosure contemplated by the ISSB climate disclosure prototype, such as climate considerations regarding executive remuneration. The proposed SEC rule does not incorporate the Sustainability Accounting Standards Board (SASB) standard or the CDP’s Climate Disclosure Standards Board – both of which are now officially integrated into the ISSB initiative. In addition, the CSRD has indicated that it will be incorporating the Global Reporting Initiative (GRI) principles as part of its ESG disclosure requirements. So while there may be fewer third-party frameworks in the marketplace given the ongoing market consolidation, companies will need to consider disclosing to the legacy ESG disclosure frameworks and standards contained within the ISSB, CSRD and SEC initiatives.

What ESG Information is Deemed “Material” to Disclose?

The SEC indicated that it is utilizing an investor-focused determination of “materiality” – similar to that of its current financial reporting requirements. Similarly, the ISSB has also indicated it will be focusing on materiality from an investor lens (also known as “single” materiality). However, the CSRD has expressed it is taking a “double” materiality perspective to its ESG disclosure rulemaking, considering how other stakeholders beyond investors might view which ESG issues are material to the company. This difference will have practical implications on companies. While the SEC and ISSB’s focus on “single materiality” disclosure requirements may sharpen a company’s ESG disclosure strategy, companies that are also subject to the CSRD will need to include the concept of “double materiality” into their disclosure strategies.

Who Can Provide External Assurance of ESG Data?

The SEC’s proposed rule contemplates that external assurance of GHG emissions data may be prepared by an independent third-party with an expertise in GHG emissions. The SEC does not preclude a company’s financial accounting firm from providing the external assurance as long as the firm has the requisite expertise, follows due process standards and meets “independence” requirements. Conversely, while the draft standards from the CSRD require “reasonable” assurance of ESG disclosures by 2026, it specifically prohibits a company’s financial auditor from providing the company’s ESG assurance, including a one-year “cooling-off” period after any financial audit has been conducted. The ISSB has also indicated that the International Organization of Securities Commissions (IOSCO) will help it develop its own external assurance standards which may or may not coincide with either the SEC or CSRD guidelines. As a result, it seems likely that companies will face multiple requirements and guidance for the external assurance of ESG data.

When Will Enhanced ESG Disclosure be Required?

Most companies would be required to include the additional climate disclosure for the 2023 fiscal year (i.e. annual reports filed in 2024), with a one-year delayed requirement for Scope 3. European Union’s CSRD is scheduled to be finalized by the end of 2023, with first disclosure required for the 2024 fiscal year (i.e. annual reports filed in 2025). In addition, the International Financial Reporting Standards Foundation (IFRS) plans to seek public consultation on its ESG disclosure standards in 2022. While it is unclear when these standards will be finalized, it is likely that standards will be finalized in the next few years. Still other disclosure frameworks continue to emerge, such as the Taskforce on Nature-related Financial Disclosures (TNFD) that recently released its draft disclosure framework supported by investors like BlackRock. This crowded and staggered timeline makes it critical for companies to evolve their ESG disclosure strategies in anticipation of these ongoing initiatives.

What Happens Next?

The SEC has requested comments on its proposed rule by May 20, 2022. Regardless of possible litigation over the proposed rule, it is entirely likely that the final rule will look very different than the current version, especially if there are well-articulated concerns raised about the effects of the proposed disclosure requirements. The SEC will listen carefully to comments from U.S. companies, so companies are well advised to comment on any valid concerns, such as the practical costs of the proposed requirements and the SEC’s approach to climate disclosure.

Conclusion

The SEC is anxious to provide leadership on climate disclosure, but it also likely wants its final rule to align with existing global disclosure initiatives to avoid concerns that it is forcing U.S. companies to adhere to multiple standards. The SEC may also want to time its final action to coordinate with other international bodies, but this may not be possible given current timelines. Because of this, we believe that the SEC’s rule will likely not simplify a company’s ESG disclosure strategy in the near-term because of the other ongoing initiatives from the ISSB and the EU’s CSRD. Institutional investors will also continue to evolve their requests for more ESG disclosure beyond these standards. It is therefore critical for companies to continue to both monitor the other ongoing ESG disclosure initiatives and adjust ESG disclosures to meet investor and other stakeholder needs.

We recommend that companies:

(i) Consider commenting on the proposed SEC disclosure rules within the 60-day comment period;

(ii) Review their current climate disclosures and practices for alignment with the SEC’s proposed rule and other pending initiatives, including board and management oversight mechanisms for climate risk; and

(iii) Continue to closely monitor the other ongoing ESG disclosure initiatives in the global marketplace and adjust ESG disclosure strategies accordingly.

Appendix