Section 01: Executive Summary

This week, Chancellor Rachel Reeves delivered Labour’s first budget in 14 years, kickstarting the age of big spending by government.

The Labour Government embarked on a bold new strategy in this week’s Budget. Against a backdrop of low growth and lower fiscal revenues, Chancellor Rachel Reeves set out a Budget that significantly increases the tax burden on all businesses and many workers. However, her Budget lives or dies by whether her tax raid can be strategically invested to end the UK’s growth deadlock and stimulate long-term economic progress. Crucially, will this gamble pay off for workers and consumers?

After a turbulent few years, the UK economy began to show some signs of improvement in H1 2024. The UK demonstrated better-than-expected growth in Q2’24 (0.6% QoQ), UK inflation continued to fall – reaching 3.1% in July ’24 – and interest rates began to decrease, albeit slowly. But these short-term trends mask long-term structural challenges that the UK faces. UK GDP continues to remain stubbornly stagnant, there is persistent inflationary pressure in the services sectors and limited economic growth. An unexpected pandemic and supply chain shortages have led to a significant increase in public debt in the last five years, while Brexit left the UK less prepared than comparable countries to accelerate out of the ‘Covid-years.’ This has all continued to stifle consumer sentiment and spending growth.

Labour has responded to its challenging fiscal and economic inheritance by flexing its natural instincts – higher taxes, higher borrowing and higher public spending. In the short-term, these actions are unlikely to affect consumers, whose household disposable income will continue to grow, at least very gradually, due to wage and benefit rises alongside curbed inflation. Businesses will feel a more immediate pinch when employer NICs increases to 15% in April 2025, and these costs will filter down to employees and consumers over the longer term. Labour will be banking on their gamble to amend the net debt definition – which allows them to borrow more to fund capital investment – to enable the UK to turn an economic corner and move towards sustainable growth. For that to work, three things must happen.

First, the government must invest in the right areas. On the demand-side, it will need to select high-growth markets where the UK is well-positioned to be a word leader. On the supply-side, it will need to invest in public services to build a large, highly skilled, highly connected workforce. But previous large public sector investments have often not yielded economic improvements. Therefore, ‘how’ Labour executes these investments is as important as ‘what’ investments it selects. Secondly, the government hopes its capital investments create a virtuous circle of long-term productivity gains, higher growth and increased fiscal revenues – this will require not just investment, but effective and efficient spending by government. Finally, Labour hopes that these economic improvements filter down to consumers to grow household income long-term.

This Budget marks the start of the age of big spending by government. But consumers will not feel wealthier tonight and employers will feel the pain of higher NICs. The government’s areas of spending appear sensible to stimulate growth, but whether it will pay off for consumers will come down to Labour’s ability to execute.

The Autumn Budget sets out a combination of tax increases and investments

Chancellor Rachel Reeves has presented a plan that raises £40bn primarily from business taxes, especially targeting employer National Insurance contributions (NICs), and promises £100bn in capital investment over the next 5 years.

Taxes and duties

- Current income tax thresholds will be frozen until 2028/2029

- Employer NICs will increase to 15%

- Capital gains tax, windfall tax, stamp duty on second homes and air passenger duties will see uplifts

Employment and welfare

- The minimum wage for adult workers will rise by 6.7% to £12.21 per hour

- State pension spending will increase by 4.1% in 2025-26, worth up to £470 more, with the pension credit minimum guarantee also increasing

Energy

- Multi-year funding for carbon capture and storage and 11 green hydrogen projects across the UK

- Funding is provided to establish GB Energy in Aberdeen as part of the commitment to make the UK a clean energy leader

Transport

- Incentives for electric vehicles through company car tax schemes will continue beyond 2028

- Funding is secured to extend HS2 to Euston Station

- £500m increase for road maintenance to help fix potholes

Education

- Schools will receive a 19% real-terms funding uplift, with £6.7bn allocated to the DoE, £1.4bn for rebuilding 500 schools and £2.1bn for maintenance

- Funding for special needs and disabilities will increase by £1bn

Healthcare

- NHS funding increase of £22.6bn over two years for service expansion and reduced wait times

- Investment of £3.1 billion for NHS capital projects, including diagnostic hubs, equipment and maintenance

Housing

- Investments worth £5bn in housing, expanding the Affordable Homes Programme to £3.1bn and supporting builders with £3bn in guarantees

- Right to Buy discounts will be reduced and local authorities can retain receipts to reinvest in housing

Industrial strategy

- Strategic investments of £1bn to aerospace, £2bn to automotive and £520m to the Life Sciences Innovative Manufacturing fund

- More than £20bn to support R&D, including £6.1bn for core research areas such as biotechnology

Section 02: Labour’s Inherited Economy has Short-term ‘Green Shoots’ but Long-term Structural Challenges

UK GDP has rebounded modestly

Following a technical recession in Q4’23, the UK economy demonstrated better-than-expected growth in Q2’24, driven by greater services output.

However, UK GDP is showing signs of stagnation

Despite strong growth in Q1 and Q2, the UK economy unexpectedly stagnated for a second consecutive month in July, driven by drops in construction and manufacturing and weak growth in services.

Inflation appears under control on the surface, but this hides the reality for consumers

UK inflation continued to fall in the first half of 2024, driven by reduced prices for consumer goods, food and beverages, which benefit from easing energy and input costs; however, persistent inflationary pressures remain in consumer-facing services.

Services inflation remains (and will remain) high

The slower inflation decline in the consumer-facing services sectors is primarily driven by wage growth and labour shortages, which may present structural inflationary risks to the UK economy.

There are three main factors currently contributing to services inflation in the UK:

Wage growth: As labour costs are a key component of the services sectors, the continued wage growth in the UK (6.0% growth in April) and the c. 10% April 2024 increase in the National Living Wage (NLW) have put significant inflationary pressure on the economy.

“Over the spring, early summer, what you should get is a pretty helpful base effect pushing the pay growth numbers down, but you’ve got less of that happening in April because of the effects of the NLW hike.” – Philip Shaw, Chief economist at Investec

Labour shortages: The UK's vacancy and economic inactivity rates remain above pre-pandemic levels, keeping the labour market tight. In addition, the proposed immigration initiatives in the UK will likely put further pressure across almost all services sectors.

“We’ve been saying for some time that we thought services inflation would be a lot harder to get down…particularly with the backdrop of the UK labour market which has loosened but is still very, very tight.’" – Cathal Kennedy, Senior UK economist at RBC Capital Markets

Lack of resilience in hospitality: Unlike retail trading businesses, the hospitality industry has more complex operating models and is not able to quickly adjust to changes in energy and commodity prices, leading to prolonged periods of inflationary pressure across the sector.

“Times are tough at the moment. We’ve really been hit by the aftermath of the pandemic, by Brexit, by the cost of living crisis…these factors have made the industry really difficult to navigate.” – Adam Quayle, Joint director at Box of Tricks

Interest rates are likely to decline very slowly

Falling inflation has increased the pressure on the BoE to reduce interest rates; however, this will likely only come when they are content that services inflation has fallen further.

Net debt remains high

Limited economic growth, an unexpected pandemic that required significant fiscal stimulus and supply chain shortages have led to a significant increase in public debt in the last five years.

Section 03: Consumer Sentiment is Improving, but Spending Growth Remains Modest, Posing Medium-term Risk

Real wages are recovering

The continued growth of wages and declining inflation have resulted in a prolonged improvement in real wages since July 2023, which is expected to continue throughout the remainder of 2024 and 2025, leading to higher levels of disposable income.

The household income picture has been more complex so far this year

In addition to growing real wages, overall household wealth levels were further supported by the Spring Budget’s tax decreases and stabilised debt servicing and housing costs.

Household net cashflow reached 2021 levels for first time

With the continued growth of real wages, households’ cash position has improved above 2021 levels due to a substantial decrease in spending growth across all categories and higher disposable income due to wage growth and recent tax cuts.

Consumers are overall £3,500 worse off due to the cost of living crisis

Despite recent improvements, on a cumulative basis, households are still significantly worse off in cash terms due to the prolonged period of falling household cashflow between 2021 and 2023, which will likely take several years to rebound.

The cost of living crisis has hit certain groups harder than others so far

Older and more wealthy households have been better shielded to date from economic uncertainty than other demographics.

The cost of living crisis has been felt most heavily in Scotland and the South East

Since the start of 2022, real wages have fallen most in Scotland and the South East; regions such as the East of England, the East Midlands and the North West have seen increases.

Retail activity remains below pre-pandemic levels

While retail sales from a volume perspective have reached their highest levels since August 2022 in the last three months, they still remain below 2019 levels.

Consumer summer spending bolstered GDP performance

Consumer spending was strong in the summer of 2024; the Office for Budget Responsibility forecasts that the new Autumn Budget measures will generate further improvements over subsequent periods.

Consumer spending is not recovering evenly

Consumer spending has demonstrated modest growth over the last six months when compared to 2023, which is partially driven by a rise in prices, with Britons still reducing consumption across some discretionary items.

Consumer sentiment has fallen sharply

While consumer confidence was increasing relatively consistently since September 2022, there has been a sharp decline in September 2024, driven by concerns over personal finances and the economy, with businesses expressing the same sentiment.

Section 04: The Autumn Budget Focuses on Increasing long-term strategic investment to stimulate growth; will it pay off for the UK consumer?

Budget announcements aimed at household income are reasonably limited

Against a backdrop of low growth and low fiscal revenues, the Labour Government has announced limited changes to the policies affecting consumers’ household income.1

Budget announcements aimed at businesses are substantial

The Labour Government has announced increases to business taxes but also changed funding rules to enable it to free up funds for investment to stimulate economic growth.1

Short-term household income will likely continue to show gradual growth

The net household position will likely continue to gradually improve over the coming quarters as interest rates continue to decrease, supporting the recovery from the cost-of-living crisis’ financial impact.

Increases to tax in the Budget will hit certain groups harder than others

The most vulnerable households will be most shielded from tax increases in the Budget, but all other groups will likely see some form of squeeze to income over the next 3-5 years.

Long-term household income remains uncertain

Long-term growth in household incomes hinges on whether the Labour Government can address the long-term structural challenges affecting the UK economy, for which it has chosen a strategy of capital investment to stimulate growth.

Labour hopes to reignite sustainable productivity growth

The UK economy has struggled to improve its productivity since the 2008 global financial crisis – in part due to underinvestment by both the private and public sectors – with this being especially felt outside of London.

In the short-term, UK industry will feel additional cost pressure from tax increases

Employers are likely to be negatively impacted in the short term by the rise in employer NICs, which the OBR estimates will increase business’ payroll costs by c. 2% on average.

Long-term growth needs investment in sectors where the UK is comparatively strong

The UK performs well in ten out of sixteen explored sectors, with the most notable in Wind (offshore) and FinTech, followed by Aerospace, A.I, HealthTech and Clean Hydrogen.

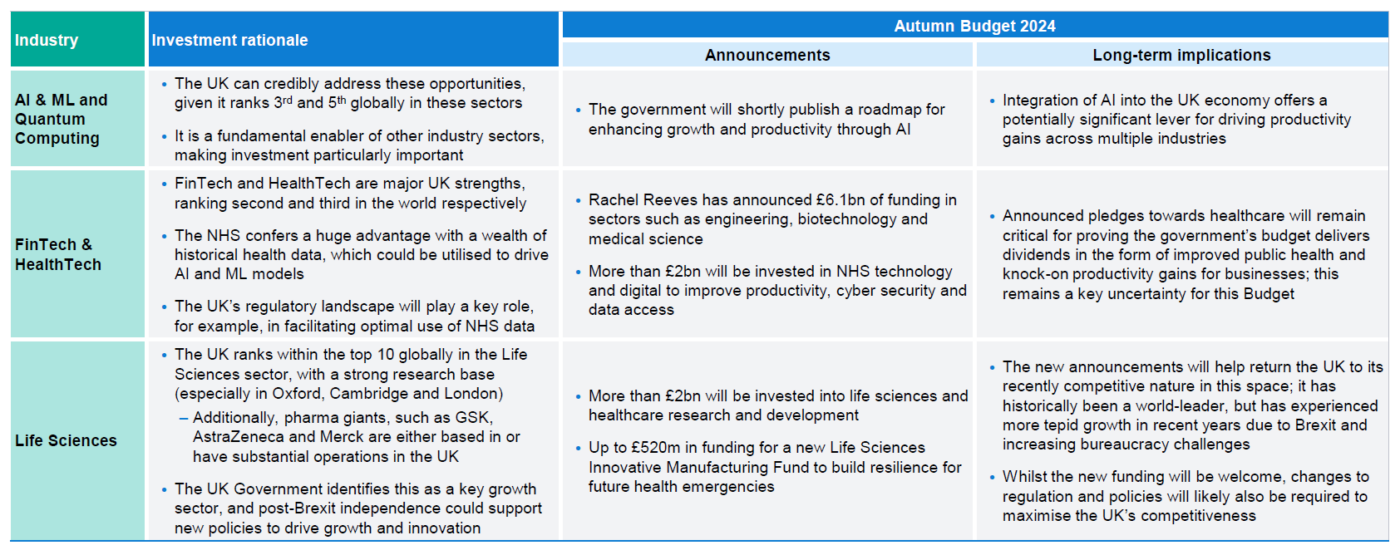

The Budget included a series of sector-specific capital investments [1/3]

The government has pledged investments across a series of innovation-led industries to help enable tech transfer and reinvigoration of private investment.

The Budget included a series of sector-specific capital investments [2/3]

The government has pledged investments across a series of innovation-led industries to help enable tech transfer and reinvigoration of private investment.

The Budget included a series of sector-specific capital investments [3/3]

The government has pledged investments across a series of innovation-led industries to help enable tech transfer and reinvigoration of private investment.

In summary, consumers will not feel wealthier from this Budget over the medium-term

The Labour Government has a narrow time window to successfully invest funds into key programmes that will deliver significant returns on investment and reinvigorate economic growth across all parts of the UK.